American Airlines (NASDAQ:AAL) shares are under pressure today after the air carrier slashed its outlook for the third quarter owing to higher fuel prices.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

AAL now expects to pay between $2.90 and $3 per gallon of jet fuel in Q3. On the back of strength in operating performance, capacity for the quarter is anticipated to remain at the high end of its initial outlook, in the range of 6% to 7%.

On top of the impact of rising fuel prices, AAL is also expecting a $230 million retroactive pay expense in Q3 after a new collective bargaining agreement with its pilots, represented by the Allied Pilots Association, was ratified. Consequently, the company now expects its operating margin to be impacted by 1.7 points, and adjusted EPS to decrease by $0.23 for the quarter.

The company now expects adjusted EPS in Q3 to be in the range of $0.20 to $0.30, compared to prior outlook of between $0.85 to $0.95. Adjusted operating margin for the quarter is anticipated between 4% to 5%, compared to the earlier estimate of between 8% to 10%.

The announcement from AAL comes after United Airlines (NASDAQ:UAL), Southwest Airlines (NYSE:LUV), and Alaska Air Group (NYSE:ALK) also provided major updates amid rising fuel prices.

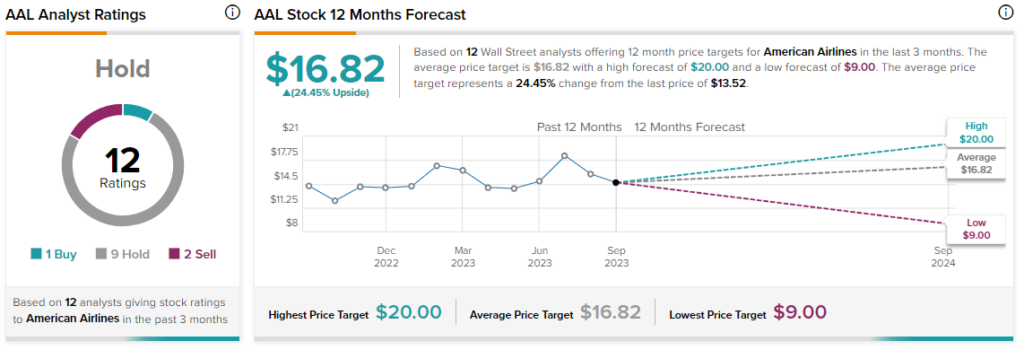

Overall, the Street has a consensus price target of $16.82 on AAL, alongside a Hold consensus rating. Shares of the company have now glided 13% lower over the past month.

Read full Disclosure