Airline stocks are in focus today after United Airlines (NASDAQ:UAL), Southwest Airlines (NYSE:LUV), and Alaska Air Group (NYSE:ALK) provided major updates amid rising fuel prices.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

During the peak summer period, Alaska Air Group now expects third-quarter revenue to rise in the range of 1% to 2%, compared to the prior growth outlook of flat to 3%. The company has undertaken a wage rate adjustment for its pilots and now expects a lower pre-tax margin, between 10% and 12%, owing to increased fuel prices.

United Airlines anticipates third-quarter revenue to rise in the range of 10% to 13%, alongside an EPS range of $3.85 to $4.34. The carrier noted that fuel prices have shot up by over 20% since the middle of July and, consequently, expects all-in fuel prices to range between $2.95 and $3.05 per gallon.

Meanwhile, Southwest Airlines expects third-quarter revenue per available seat mile to decline in the range of 5% to 7%, compared to earlier expectations in the range of 3% to 7%. The airline has seen an impact from weather events, including the Maui wildfires and hurricanes Hilary and Idalia. Furthermore, the company now anticipates fuel cost per gallon between $2.70 and $2.80, compared to previous expectations in the range of $2.55 to $2.65.

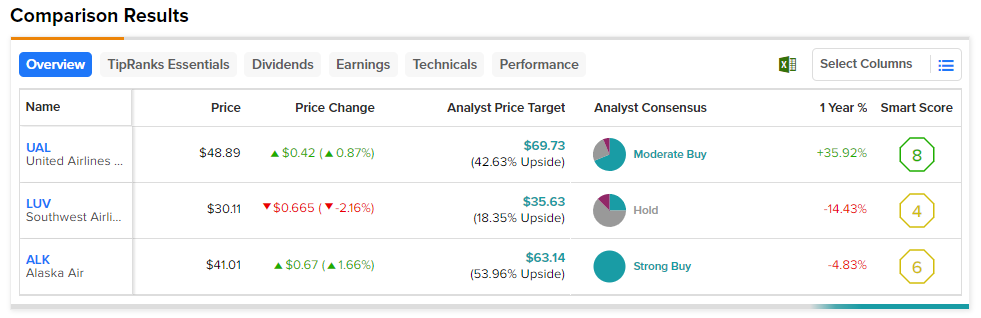

Travel trends have remained considerably buoyant so far in 2023, and UAL shares jumped nearly 36% over the past year. While Alaska Air has dropped nearly 5% over the past year, Wall Street also sees a substantial potential upside of 54% in the stock.

Read full Disclosure