Dell Technologies (NYSE: DELL) reported stronger-than-expected Q1 results for the ninth straight quarter, topping both earnings and revenue estimates.

Robust demand and continued strength in commercial PCs led to strong performance across all segments.

Following the news, shares of the tech giant gained more than 12% during the extended trading hours.

Q1 Beat

Adjusted earnings of $1.84 per share grew 36% year-over-year and significantly beat analysts’ expectations of $1.40 per share. The company reported earnings of $1.35 per share in the prior-year period.

On top of that, revenues jumped 15.6% year-over-year to $26.12 billion and exceeded consensus estimates of $25.2 billion.

The revenue rise reflects a surge in Infrastructure Solutions Group revenues, which increased 16% to $9.3 billion, as well as 17% growth in Client Solutions Group revenues to $15.6 billion.

Notably, recurring revenue during the quarter jumped 15% to $5.3 billion, while remaining performance obligations grew 14% year-over-year to $42 billion.

Management Commentary

Dell Technologies CFO, Tom Sweet, commented, “We are delivering long-term value by executing our strategy for growth, taking share, generating strong cash flow from operations and executing our capital allocation framework.”

Wall Street’s Take

Following the results, Raymond James analyst Simon Leopold increased the price target on Dell to $58 from $57 and reiterated a Buy rating.

The rest of the Wall Street community is cautiously optimistic about the stock, with a Moderate Buy consensus rating based on six Buys and three Holds. The average Dell Technologies price target of $60 implies 21.61% upside potential to current levels.

Bloggers Weigh In

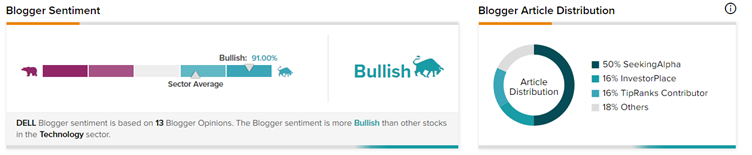

TipRanks data shows that financial blogger opinions are 91% Bullish on DELL stock, compared to a sector average of 67%.

Bottom-Line

Notably, Dell shares have gained over 70% over the past year, massively outperforming the benchmark indices.

Recently, technology companies continued to struggle with global chip shortages and supply chain disruptions further heightened by the Russia-Ukraine conflict and the lockdown situation in China.

In these uncertain times, it is even more encouraging that Dell reported an outstanding Q1 beat despite belonging to the tech space that has witnessed gigantic sell-offs.

Read full Disclosure

Related News:

Booz Allen Hamilton Posts Q4 Beat & Issues Muted Guidance

AstraZeneca Wins EU Approval for COVID-19 Vaccine as Booster

Why Does Apple Want to Shift Its Base From China to India & Vietnam?