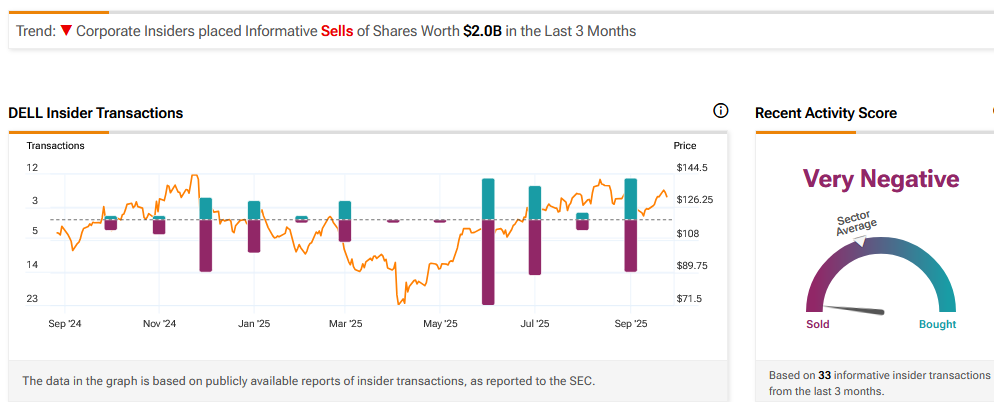

Corporate insiders at software giant Dell Technologies (DELL) have placed Informative Sells of shares in the company worth $2 billion in the last three months.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Selling Pattern

Informative sells can often be taken as an indication that the insider believes the stock price of the company is set to head downwards.

However, an insider might sell shares for other reasons, such as financial or personal obligations.

The activity includes Silver Lake Group, a private equity firm focused on technology investment, and its affiliates selling $76.2 million worth of Dell Class C Common Stock on September 15. The sales occurred at prices ranging from $126.63 to $127.7 per share.

Yesterday, September 24, director SLTA IV (GP), L.L.C. and director SLTA V (GP), L.L.C. each sold 824,999 shares of Dell Technologies stock, with each sale valued at $112,181,708. This significant transaction reflects a combined sale of 1,649,998 shares, totaling $224,363,416.

On September 23rd, director SLTA IV (GP), L.L.C. sold 318,171 shares valued at $42million with director SLTA V making the same move.

AI Performance

The Dell stock is currently trading at $132.09, up 16.30% in the year-to-date – see below:

It also reported record revenue of $29.8 billion, up 19% year-over-year, in the second quarter. AI server shipments were a significant driver, with $5.6 billion in orders and $8.2 billion shipped, resulting in a backlog of $11.7 billion.

Earnings per share increased by 19% to $2.32, marking a Q2 record. Cash flow from operations was $2.5 billion, driven by profitability and revenue growth.

It even increased its full-year revenue guidance to a range of $105 billion to $109 billion.

However, some analysts believe AI servers “may have already lived their best life” as the technology evolves. Dell stock dropped after its Q2 results as it said Q3 adjusted earnings per share would have a midpoint of $2.45, missing the $2.55 analysts were expecting.

DELL stock currently has a Very Negative Insider Confidence Signal on TipRanks. As can be seen above, that is much worse than the sector average.

It is important to keep an eye on the Informative trades of corporate insiders, given their knowledge of a company’s growth potential. Interestingly, TipRanks offers daily insider transactions as well as a list of top corporate insiders. It also provides a list of hot stocks that boast either a Very Positive or Positive insider confidence signal.

Is DELL a Good Stock to Buy Now?

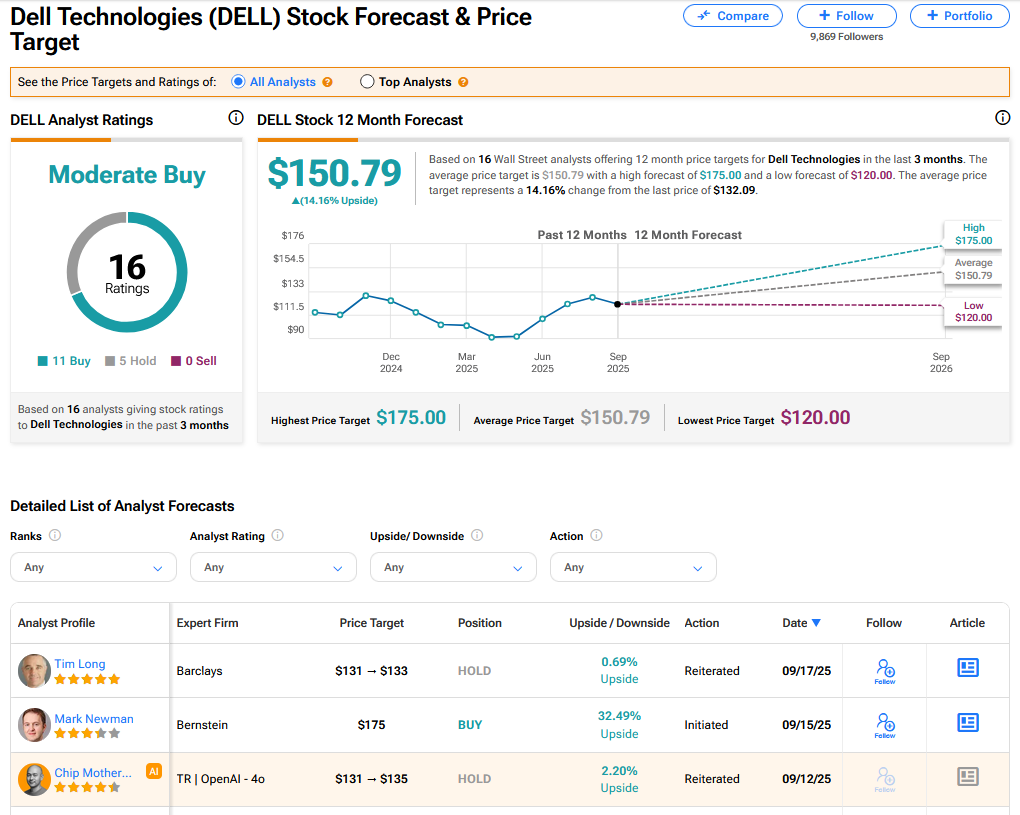

On TipRanks, DELL has a Moderate Buy consensus based on 11 Buy and 5 Hold ratings. Its highest price target is $175. DELL stock’s consensus price target is $150.79, implying a 14.16% upside.