Dave & Buster’s (NASDAQ:PLAY) stock is going vertical, but don’t press your luck if you missed the share-price move. I am neutral on PLAY stock and wouldn’t dare to short it, but Dave & Buster’s financial figures don’t seem to justify the rally that’s currently in progress.

Dave & Buster’s operates a chain of entertainment centers that feature video games, air hockey, and other hands-on games, food, beverages, and more diversions. It’s fun to go to Dave & Buster’s occasionally, but is it a good company in which to invest your hard-earned capital?

Evidently, the market is voting “yes” and strongly believes in the growth story of Dave & Buster’s. Be cautious, though, especially if that growth story is based on the optimism of Dave & Buster’s management rather than on the company’s current data.

PLAY Stock Jumps Despite Revenue and Earnings Misses

The market can be massively confusing sometimes. If Dave & Buster’s missed Wall Street’s top-line and bottom-line forecasts, shouldn’t PLAY stock go down? That would make logical sense, but there’s more to the story than meets the eye.

Here’s what’s going on. Dave & Buster’s just released its financial results for the fourth quarter of Fiscal Year 2023. Currently, PLAY stock is up over 11%. Therefore, the company must have posted spectacular quarterly results, right?

Actually, no. Dave and Buster’s Q4-FY2024 revenue increased 6.3% year-over-year to $599.1 million, which is decent, but I wouldn’t call this level of sales growth spectacular. To me, it just indicates that Dave & Buster’s did reasonably well during a quarter in which U.S. inflation was somewhat high but not out of control.

Meanwhile, the consensus estimate from analysts called for Dave & Buster’s to generate quarterly revenue of $602.61 million. Therefore, the company fell short of Wall Street’s top-line forecast.

Furthermore, Dave & Buster’s pro forma combined comparable-store sales (including Main Event branded stores) decreased 7% year-over-year. For this less-than-ideal result, Dave & Buster’s management blamed “abnormally adverse weather conditions.” Reportedly, the company’s comparable sales have declined for four consecutive quarters.

Additionally, Dave & Buster’s adjusted earnings of $1.03 per share marked an improvement over the year-earlier quarter’s result of $0.85 per share. However, Dave & Buster’s fell short of the analysts’ consensus prediction of $1.10 per share in quarterly earnings.

Dave & Buster’s Stirs Up Confidence with High Financial Target

It can be dangerous to invest in a company after a vertical share-price move, especially when that move is mostly based on management’s confidence. In the case of Dave & Buster’s, the management team has an optimistic financial goal, but there’s no guarantee that the company will actually meet that goal.

Yet, it looks like the market has already priced its bullish assumptions into PLAY stock. Most likely, this happened because Dave & Buster’s CEO Chris Morris boasted about the company’s “anticipated opening of an additional 15 new domestic stores” and expressed his confidence in the company’s “ability to achieve the $1 billion Adjusted EBITDA target in the coming years.”

Maybe Dave & Buster’s will actually open up 15 new stores in the U.S. That would be fine, but it hasn’t actually happened yet. Besides, it wouldn’t justify the melt-up in Dave & Buster’s stock unless there are other additional catalysts.

As for the adjusted EBITDA target of $1 billion, this is far from guaranteed. In the entirety of Fiscal Year 2023, Dave & Buster’s totaled $555.6 million in adjusted EBITDA. That’s slightly more than half of Morris’s $1 billion objective.

For what it’s worth, Dave & Buster’s management also approved an additional $100 million worth of share buybacks, bringing the approved share repurchase total to $200 million. There’s no denying that this is positive news for PLAY stockholders. Yet share buybacks really ought to be the icing on the cake. They’re a nice bonus in a company’s overall financial profile, not a reason to panic buy a stock, as some traders are apparently doing.

Is Dave & Buster’s Stock a Buy, According to Analysts?

On TipRanks, PLAY comes in as a Moderate Buy based on two Buys and two Hold ratings assigned by analysts in the past three months. The average PLAY stock price target is $71.67, implying 3.9% upside potential.

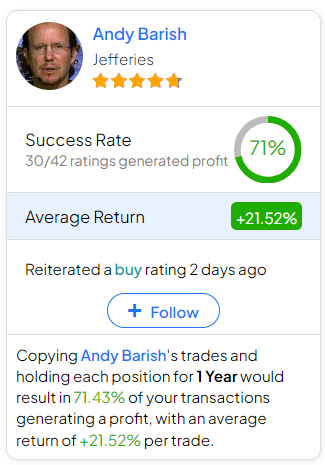

If you’re wondering which analyst you should follow if you want to buy and sell PLAY stock, the most profitable analyst covering the stock (on a one-year timeframe) is Andy Barish of Jefferies, with an average return of 21.52% per rating and a 71% success rate. Click on the image below to learn more.

Conclusion: Should You Consider Dave & Buster’s Stock?

Dave & Buster’s revealed subpar comparable-store sales results and missed Wall Street’s quarterly consensus estimates for revenue and earnings. At the same time, the market went on a share-buying spree, probably based on Dave & Buster’s optimistic adjusted EBITDA target.

For me, at least, achieving a target is more important than establishing one. Now, Dave & Buster’s has the challenging task of meeting its own ambitious expectations, along with justifying its high share price. Consequently, I am choosing to stay neutral on PLAY stock and am not currently considering it.