Shares of food delivery platform DoorDash (DASH) plummeted nearly 10% during early trading on Thursday. This came after the company’s third-quarter financial results surpassed Wall Street’s revenue projection but fell short of what analysts expected for its earnings per share.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

During the quarter, DoorDash’s revenue grew by more than 27% from $2.71 billion a year ago to reach $3.45 billion, exceeding the consensus forecast of $3.36 billion. However, it earned 55 cents per share, which is below the 68 cents anticipated on Wall Street — the figure skyrocketed by 44.7% from 38 cents during the same quarter last year.

DoorDash Generates $25B on 776 Million Orders

DoorDash’s revenue growth was fueled by $25 billion in marketplace gross order value (GOV) — this rose 25% from the prior year quarter. This value refers to sales generated by its delivery drivers (‘Dashers’), local restaurants, convenience stores, and retailers who sell food and other goods via its platform.

The gross order value rode on a 21% increase in total orders processed by the platform, with orders hitting 776 million during the quarter. DoorDash explained that expansion in the number of consumers and their higher average engagement levels spurred the growth in orders.

DoorDash Says It Is ‘Still in Our Early Stages’

Looking ahead, DoorDash expects its margins for the next fiscal year to go “up slightly” from its current position. The California-based food delivery company predicts that it will generate between $710 million and $810 million in adjusted earnings before interest, tax, depreciation, and amortization.

This growth will be fueled by a higher marketplace GOV, expected to come in between $28.9 billion and $29.5 billion by the end of its ongoing quarter. Although DoorDash noted that it is “still in our early stages,” the company is aiming to expand its gross order value to $100 billion by 2026.

This is even as the delivery company, which is in the process of taking over British online food delivery company Deliveroo (GB:ROO) in a $3.9 billion deal, expects to commit “several hundred million dollars more” to new initiatives and platform development in 2026.

The company further noted that “many of our experiments are now ready for greater investment.” Analysts expect its Deliveroo acquisition to fuel its future growth.

Is DASH a Buy or Sell?

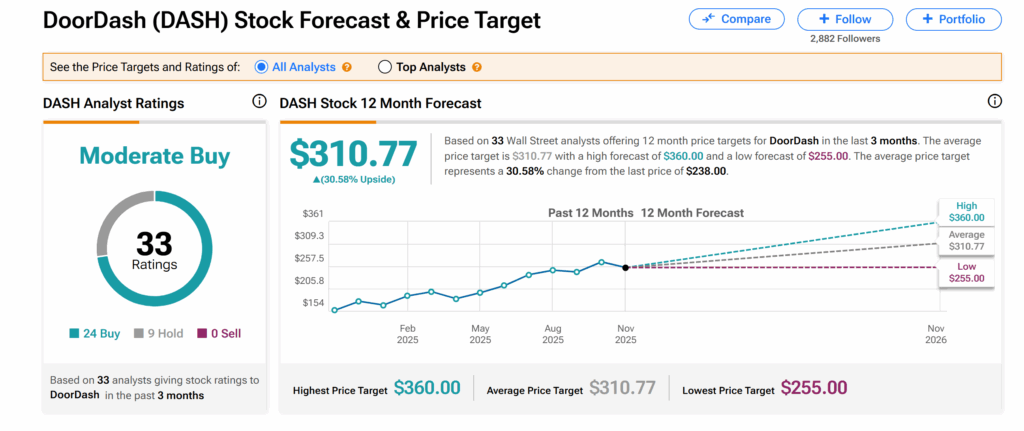

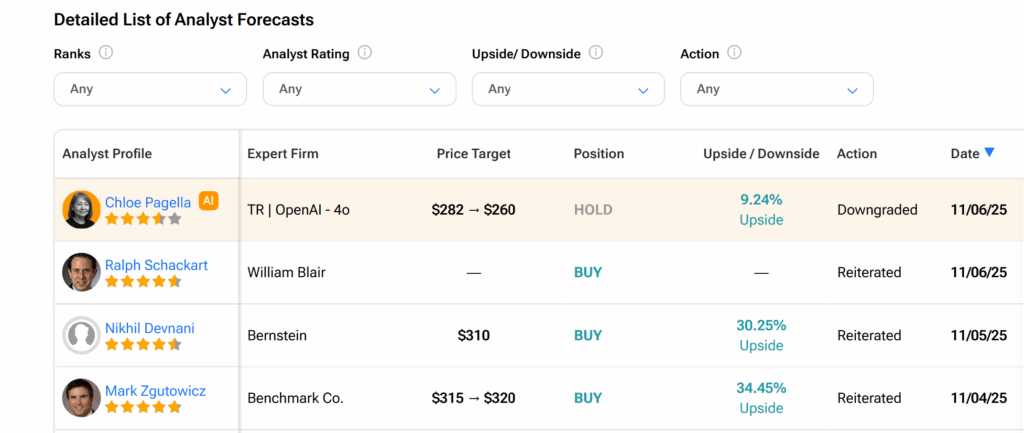

On Wall Street, DoorDash’s shares currently hold a Moderate Buy consensus rating, according to TipRanks. This is based on 24 Buys and nine Holds assigned by 33 analysts over the past three months.

Moreover, the average DASH price target of $310.77 indicates about 31% upside potential from the current trading level.