Darden Restaurants (NYSE:DRI), a multi-brand restaurant operator, slid in pre-market trading after the company announced adjusted earnings of $1.84 per diluted share in the fiscal second quarter, up by 21.1% year-over-year. This was above the consensus estimate of $1.74 per share.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The company’s sales increased by 9.7% year-over-year to $2.7 billion in the second quarter. The rise in sales was driven by a comparable restaurant sales gain of 2.8% and sales from the “addition of 78 company-owned Ruth’s Chris Steak House restaurants and 45 other net new restaurants.” Analysts had forecasted total sales of $2.74 billion.

Darden’s Board of Directors declared a quarterly cash dividend of $1.31 per share payable on February 1, 2024, to shareholders of record at the close of business on January 10, 2024. During the quarter, the company repurchased around 1.2 million shares worth $181 million.

Looking forward, in FY2024, the company has forecasted total sales of around $11.5 billion, with comparable sales expected to grow in the range of 2.5% to 3%. Adjusted diluted net earnings from continuing operations are likely to be between $8.75 and $8.90 per share.

Is DRI a Good Stock to Buy?

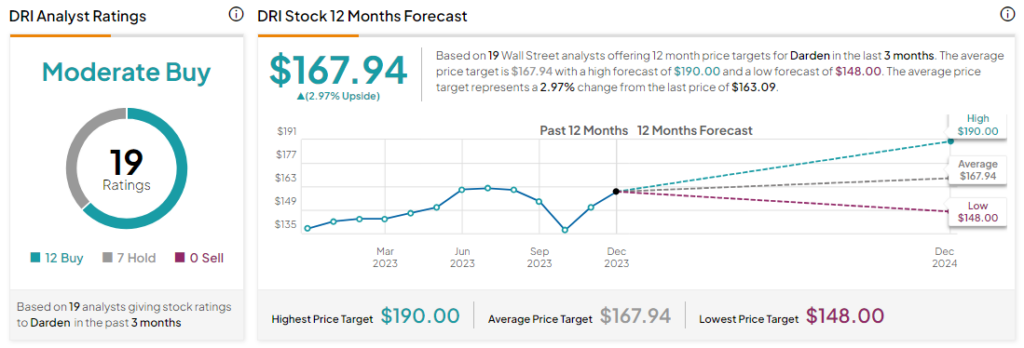

Analysts are cautiously optimistic about DRI stock, with a Moderate Buy consensus rating based on 12 Buys and seven Holds. DRI stock has gone up by more than 15% in the past year, and the average DRI price target of $167.94 implies upside potential of 3% at current levels.