The price of oil is tracking for a second weekly decline as worries about a worldwide oversupply of crude persist.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Concerns of excess supply and slowing U.S. demand have dragged crude prices lower since late October. On Nov. 7, Brent crude oil, the international benchmark, is trading at $63.65 per barrel, while the price of West Texas Intermediate (WTI) crude, the American standard, is at $59.72 a barrel, having fallen below the key support level of $60.

Both benchmarks are on track to post weekly declines of nearly 2% as leading global producers raise their output and cause fears that the global market is being swamped by an oversupply of crude oil. The slumping prices are weighing on the stocks of leading oil producers such as Chevron (CVX), Shell (SHEL), and ExxonMobil (XOM).

OPEC+ Moves

An unexpected U.S. inventory buildup of 5.2 million barrels has only added to oversupply fears gripping the commodities market as signs point to an economic slowdown in America. U.S. crude stocks have risen more than expected due to reduced refining activity, the Energy Information Administration said earlier this week.

At the same time, the Organization of the Petroleum Exporting Countries and its allies (OPEC+) announced recently that they plan to again increase their output in December before curtailing production in the first quarter of 2026. Continued output increases by the OPEC+ cartel have pushed crude prices lower throughout this year.

Is CVX Stock a Buy?

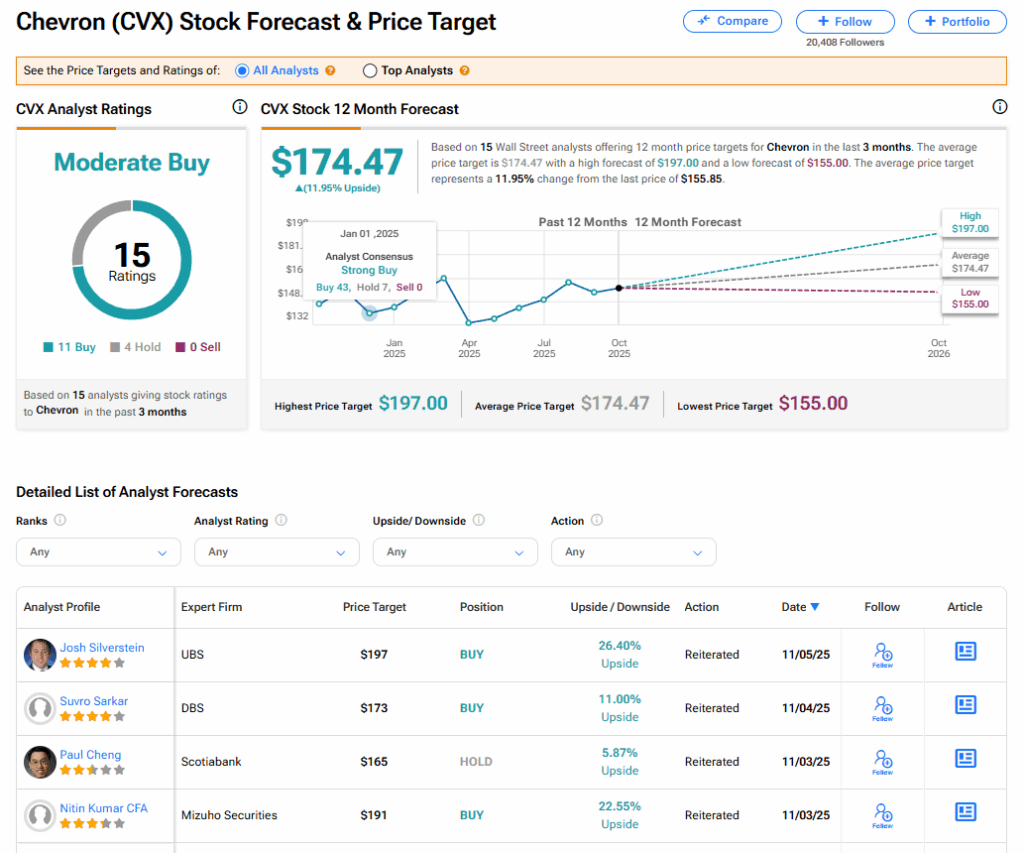

The stock of Chevron has a consensus Moderate Buy rating among 15 Wall Street analysts. That rating is based on 11 Buy and four Hold recommendations issued in the last three months. The average CVX price target of $174.47 implies 11.95% upside from current levels.