The shares of CVS Health (CVS) are feeling healthier today after the retail pharmacy chain reported third-quarter results that beat Wall Street’s expectations.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

CVS Health Hits ‘Record High’ Revenue

During the quarter, the healthcare company’s total revenue reached “a record high” of $102.9 billion, up 7.8% compared to the same period last year. Its adjusted earnings per share (EPS) grew 18% to $1.60. Both figures comfortably top analysts’ EPS and revenue expectations of $1.37 and $98.81 billion, respectively.

The strong performance came as Caremark, the health company’s division that manages prescription drug benefits for employers, health plans, and government agencies, brought in almost $6 billion after “another strong selling season.”

Omnicare’s Bankruptcy Fails to Slow CVS Health

In addition, CVS Health’s record-breaking revenue shows it is doing fine, despite its Omnicare subsidiary’s ongoing Chapter 11 bankruptcy proceedings in Texas. The healthcare company acquired Omnicare — an organization that provides pharmaceutical care and consulting to skilled nursing, assisted living, and chronic care institutions — for over $10 billion in 2015.

Recently, Omnicare was ordered to pay $949 million in restitution and penalties by a U.S. district court. The judgment came after a jury found the subsidiary liable for fraudulently billing the U.S. government over several years for medications that were wrongfully prescribed.

CVS Health Raises Guidance

Following up on its strong performance, CVS Health now expects to generate earnings per share between $6.55 and $6.65 at the end of its current fiscal year. The new range beats its previous estimate of $6.30 to $6.40 per share.

Is CVS a Good Stock to Buy Now?

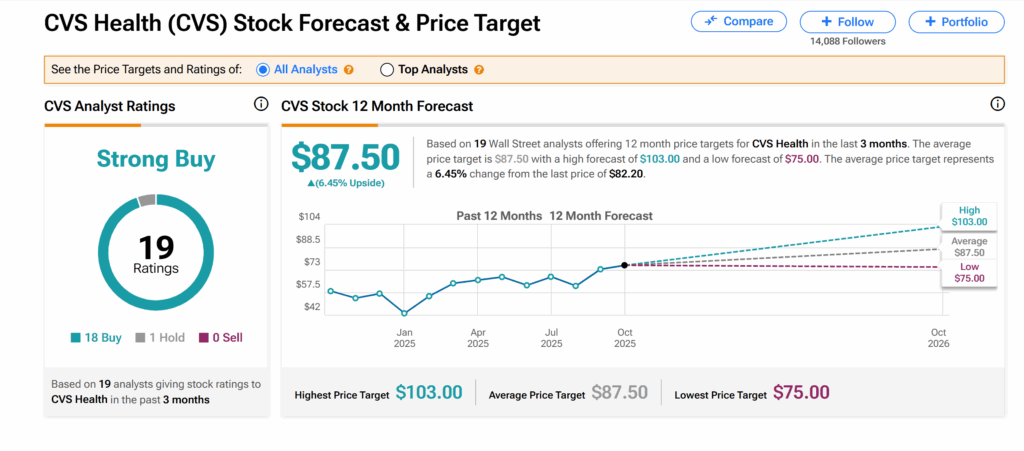

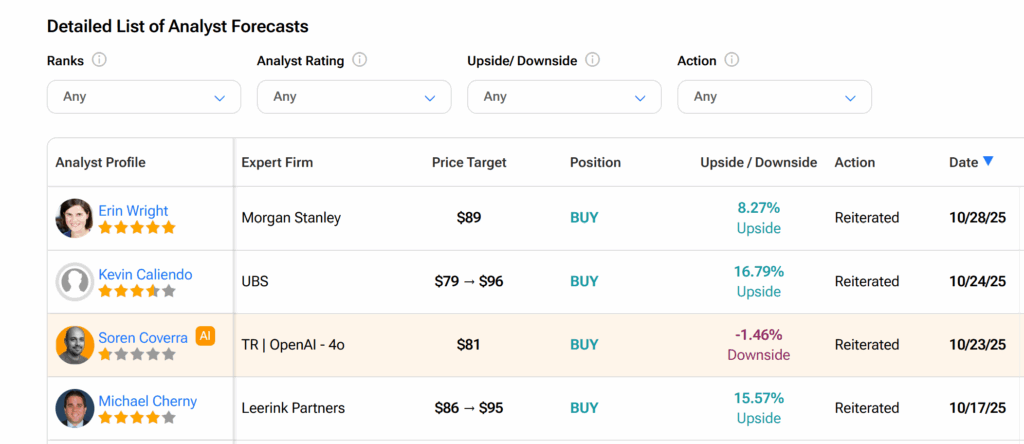

On Wall Street, CVS Health’s shares currently boast a Strong Buy rating from analysts, according to TipRanks. This is based on 18 Buys and one Hold assigned by analysts over the past three months.

Moreover, the average CVS price target of $87.50 suggests more than 6% growth potential from the current level. Since the start of the year, CVS stock has surged nearly 91%, hitting $84 per share during early trading on Wednesday.