Shares of CVS Health (NYSE: CVS) were on an upward trajectory in pre-market trading on Wednesday as the healthcare company after months of speculation, finally confirmed its acquisition of Oak Street Health (OSH) in an all-cash deal worth $10.6 billion at $39 per share.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

CVS expects the acquisition to close later this year.

CVS Health President and CEO Karen S. Lynch commented, “Combining Oak Street Health’s platform with CVS Health’s unmatched reach will create the premier value-based primary care solution.” This acquisition is expected to improve healthcare outcomes and reduce costs for patients, particularly in underserved communities as more than half of OSH’s Health Centers are located in such areas.

In addition, CVS announced its fiscal Q4 results with revenues of $83.8 billion, up 9.5% year-over-year, beating Street estimates by $7.43 billion. Adjusted earnings came in at $1.99 per share, surpassing analysts’ expectations of $1.92.

For FY23, adjusted EPS is expected to come in between $8.70 and $8.90 versus the consensus estimate of $8.86.

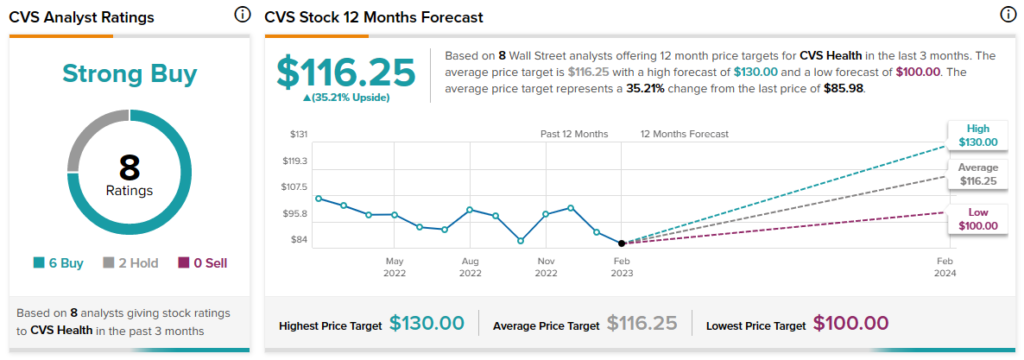

Analysts are bullish on CVS stock with a Strong Buy consensus rating based on six Buys and two Holds.