From a superficial perspective, it’s not difficult to see why the few Wall Street analysts that do cover hydrocarbon refining specialist CVR Energy (NYSE:CVI) rate it as a Sell. Narrative wise, fossil fuels clash with the broader push for clean and renewable energy infrastructure. However, this framework overlooks key positive factors that could boost shares. Therefore, I am bullish on CVI stock as a contrarian opportunity.

CVI Stock Faces an Uphill Advocacy Challenge

Before discussing the upside angle for CVI stock, it’s helpful to acknowledge the underlying advocacy problem. CVR Energy focuses on petroleum refining and marketing, along with nitrogen fertilizer manufacturing activities in the U.S. Naturally, the company’s refining and supplying of gasoline raises concerns about long-term viability.

Last month, the Biden-Harris administration revealed that it is investing $2.3 billion in projects to expand affordable and reliable clean power in rural communities. Part of the initiative involves helping fund utility providers and electric cooperatives build and improve renewable energy systems. That’s just one example.

On the international front, Russia’s invasion of Ukraine sparked much soul-searching among Western nations. As a response, many prioritized ending their dependence on Russian hydrocarbons, including accelerated efforts to transition to renewables. Factor in the environmental narrative, and the case is seemingly sealed.

With that, it’s not difficult to understand that among the three analysts who have covered CVI stock since October 2023, the unanimous assessment was a discouraging Sell. Unsurprisingly, then, the forward projections don’t bode well.

For the current Fiscal Year, analysts anticipate that earnings per share will land at $2.89 on revenue of $8.22 billion. That’s noticeably lower than last year’s earnings per share of $5.64 on sales of $9.25 billion. What’s worse, even the most optimistic projections – EPS of $4.13 on revenue of $9.11 billion – still fall short of Fiscal 2023’s results.

And to be fair, CVR wasn’t always on its game last year. For instance, in the third quarter, the company posted EPS of $1.89 against an expected target of $1.93. Nevertheless, CVI stock can surprise people.

Forecasts Bake in a Paradigm That Might Not Materialize

While the stated forecasts appear incredibly ugly for CVI stock, it’s difficult to trust them. Sure, if those numbers materialize, then absolutely, CVR Energy is a Sell. However, the contrarian point is that significant doubts exist that warrant zigging when others are zagging.

First, the world continues to run on oil. Much of this reality centers on the physical laws of our universe. Fossil fuels command significant energy density that has few superior alternatives. Until radical advancements in solid-state batteries enter the commercial market at scale, hydrocarbons will likely remain king.

Second, Russia’s military belligerence shows no sign of ending soon. In fact, with France making serious noise about protecting European democracy, the conflict will almost certainly accelerate. And that means that the potential outflow of oil to Western nations from Russia may be axed indefinitely.

Third, one of the key catalysts for hydrocarbons – and thus CVI stock – is fading EV demand. It wasn’t too long ago that the automotive industry was pivoting aggressively toward electrification. Recently, though, many of the big guns in the legacy automotive world have started to scale back or delay their transition plans.

What’s worrisome about this last point is that it comes down to simple math. If demand was robust, automakers wouldn’t be scaling back anything. They would go full bore into EVs. Further, with a favorable government ruling in the U.S. granting combustion-powered cars a viability runway through 2030, the EV slowdown may be exacerbated.

If that’s the case, demand will likely rise for petroleum refining services. That’s a huge plus for CVI stock that analyst projections are not factoring in. Generally, it’s not a great idea to go against the experts. However, in this case, risk-tolerant investors may want to consider making an exception to the rule.

CVI Stock’s Undervalued Status Might Not Last

With political and economic realities converging favorably for hydrocarbons, the undervalued status of CVI stock might not last.

Currently, CVI stock trades at a trailing-year earnings multiple of 4.66x. That’s ridiculously undervalued compared to the sector average of 11.2x. However, because the Street’s experts see a huge reduction in earnings and growth for the current fiscal year, the forward earnings multiple stands at 12.9x. That makes CVR Energy appear overvalued.

Again, though, the refining specialist’s fundamentals are arguably bullish. Therefore, the “true” earnings multiple could be somewhere between the trailing year and forward print. That would still make CVI stock undervalued.

What Is the Price Target for CVI Stock?

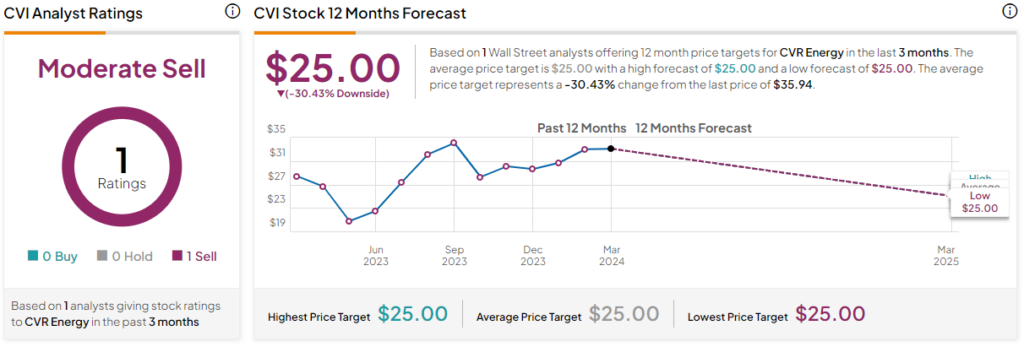

Turning to Wall Street, CVI stock has a Moderate Sell rating based on just one Sell rating assigned in the past three months. CVI stock’s price target is $25, implying 30.4% downside risk.

The Takeaway: CVI Stock Offers a Bold but Rational Contrarian Wager

While going against expert consensus is risky, with CVR Energy, an exception could possibly be made. Fundamentally, the implied supply constraint and demand increase for hydrocarbons should bolster CVI stock. Further, the financial projections assume a worst-case scenario, making CVI look overvalued when it could potentially be undervalued.