Almost a year after the banking crisis of Spring 2023, banks have stabilized and even thrived. Customers Bancorp (NYSE:CUBI) has been among the latter group. Consistently delivering earnings that have surpassed both consensus expectations and previous estimates, CUBI stock garnered the attention of analysts and investors alike. Over the past year, the stock has appreciated nearly 71%. Yet year-to-date, CUBI stock has posted middling to negative results, causing some to wonder if it has run out of steam or if it is taking a breather to make another push higher.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

A Banking Bounty

West Reading-based Customers Bancorp, Inc. operates as the bank holding company for Customers Bank, which provides financial products and services to individual consumers and small and middle-market businesses.

The bank offers traditional deposit banking products, more specialized lending for finance, technology, and venture, and a blockchain-based instant B2B payments platform.

This platform allowed Customers Bancorp to step in and attract a significant number of new clients after crypto-friendly lenders Silvergate Capital Corp. and Signature Bank collapsed.

Analysts Take Notice

Last month, Customers Bancorp reported solid Q4 2023 results, with GAAP earnings per share (EPS) surging 132.5% to $1.79, ahead of Wall Street’s consensus estimate of $1.69.

Analysts’ reactions to CUBI’s accelerated growth have been positive. Analysts at DA Davidson reiterated a Buy rating on CUBI stock and raised the price target to $72 from $71, citing potential growth of 10% to 15% in pre-provision net revenue (PPNR) in 2024.

Last month, B.Riley analyst Hal Goetsch also raised the firm’s price target to $77 from $62 and reiterated a Buy rating on the shares, fueled by solid momentum in the deposit franchise in Q4 2023. Goetsch was joined by KBW analyst Michael Perito and Maxim Group analyst Michael Diana, both reiterating a Buy rating recently.

What is the Price Target for Customers Bancorp?

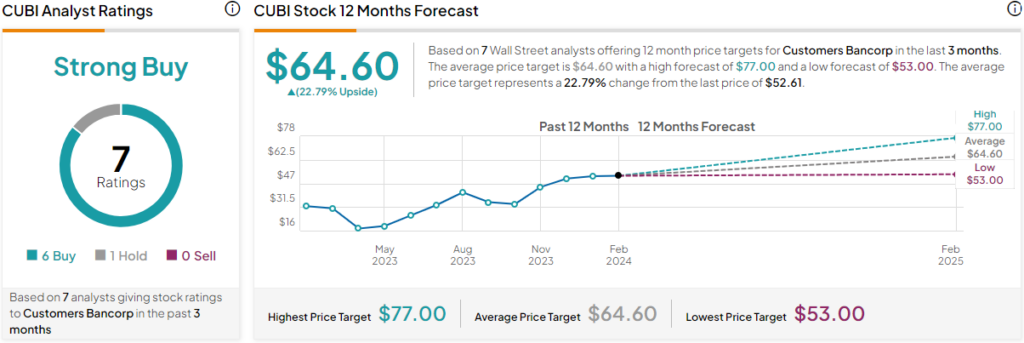

CUBI scores a Strong Buy consensus rating based on the ratings of seven Wall Street analysts who have reviewed Customers Bancorp stock in the last three months. The average price target is $64.60, with a high forecast of $77 and a low forecast of $53. The average price target represents a 22.79% upside from Tuesday’s closing price of $52.61.

Final Thoughts

Despite the stock’s year-to-date lackluster performance, Customers Bancorp maintains a firm footing in the market. The bank’s innovative strategy in providing specialized financial services and its technology-driven approach has secured the confidence of leading analysts. Although the stock has declined year-to-date, the consensus amongst analysts is a Strong Buy.

Whether the stock is resting or preparing to charge forward, the long-term view around Customers Bancorp remains bullish, suggesting that this could be a temporary dip before another surge.