CureVac (NASDAQ:CVAC) stock gained over 12% in yesterday’s extended trading session after the company announced an important disclosure regarding its cancer vaccine candidate. The biopharmaceutical company made an announcement that it had successfully administered the investigational cancer vaccine CVGBM to its first patient as part of a Phase 1 study.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

CVGBM is based on messenger-RNA technology for treating glioblastoma and astrocytoma, both of which are cancer types originating in the brain.

CureVac’s open-label study for CVGBM is designed to assess the safety and tolerability of the cancer vaccine when administered alone or in conjunction with chemotherapy. The study will involve patients who have undergone surgical resection and completed radiotherapy. CureVac plans to share the initial results of this study in the second half of 2024.

Additionally, the study will be conducted in two parts: dose escalation and dose expansion. CureVac is currently conducting these trials in locations including Germany, Belgium, and the Netherlands.

Is CVAC a Buy, Hold, or Sell Stock?

CVAC stock has gained about 80% so far in 2023. The company has benefited from positive trial data regarding its flu vaccine and COVID-19 vaccine. Moreover, the company’s extensive pipeline of products is a promising factor that augurs well for its long-term growth potential.

CureVac has a Moderate Buy consensus rating based on four Buys and one Sell. The average CVAC stock price target of $17.80 implies 55.2% upside potential from the current level.

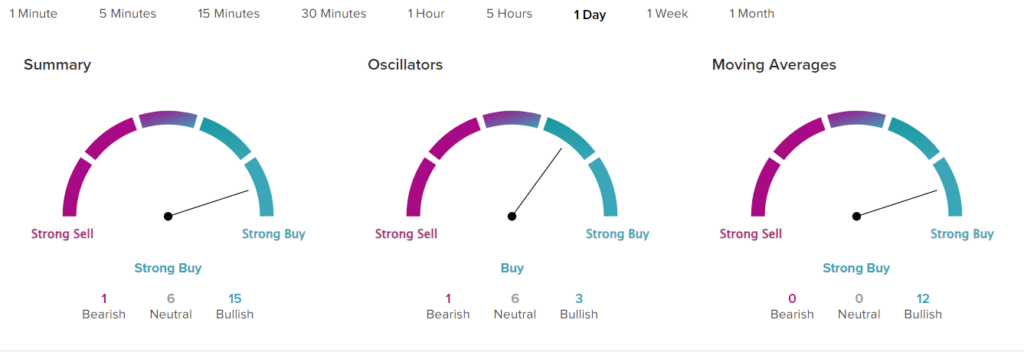

Interestingly, most technical indicators indicate that CVAC stock is a Buy. According to TipRanks’ easy-to-understand technical analysis tool, the stock’s moving average convergence divergence (MACD) indicator is 0.43, suggesting CureVac is a Buy.