Curaleaf Holdings (TSE: CURA) reported higher revenues in the fourth quarter of 2021 and a smaller loss compared to a year ago.

The cannabis company sells a variety of products including cannabis-infused drinks, edibles, dried flowers, and vapes.

Revenue & Earnings

Total revenue came in at $320 million for Q4 2021, an increase of 39% from Q4 2020. Retail revenue was $226 million, up 37% from $165 million in the prior-year quarter. Retail revenue represented 71% of total revenue.

Wholesale revenue increased 46% year-over-year to $94 million.

Net loss attributable to Curaleaf Holdings was $27.5 million, compared to a net loss of $54.5 million in the fourth quarter of 2020. Adjusted EBITDA was $80 million for the quarter ended December, 2021, up 48% from the same quarter a year ago.

During the fourth quarter, Curaleaf opened eight new retail dispensaries including one in Arizone, two in Colorado, and five in Florida.

The cannabis company signed a national distribution agreement with Southern Glazer’s Wine & Spirits to integrate Curaleaf’s Hemp and Select CBD product lines into Southern Glazer’s distribution network.

Management Commentary

Boris Jordan, executive chairman of Curaleaf, commented, “2021 was another exceptional year for Curaleaf. We reached a significant milestone by generating over 90% revenue growth and exceeding $1.2 billion of total revenue for the first time. We continued to deliver gross and Adjusted EBITDA margin expansion and ended the year with one of the strongest balance sheets in the industry to support our ongoing growth strategies. In addition, we announced strategic acquisitions that have strengthened our ability to continue gaining share in key U.S. markets as well as internationally.

“Looking to 2022, we remain focused on executing our plan for strong, above market revenue growth and margin accretion, and believe we are incredibly well positioned to benefit from significant near-term catalysts such as the anticipated launch of New Jersey’s adult use market.”

Wall Street’s Take

Following the results, Alliance Global Partners analyst Aaron Grey kept a Buy rating on CURA and lowered its price target to C$15 (from C$21). This implies 105.5% upside potential.

Grey rating comes after Curaleaf reported quarterly sales “roughly in line” with its estimates as well as EBITDA dollars and margins above its estimates and those of the Street.

Despite the 2022 sales forecast below the Street, the analyst thinks the company’s mid-point view is “achievable and beatable,” absent a noticeable change with consumer wallets or regulators.

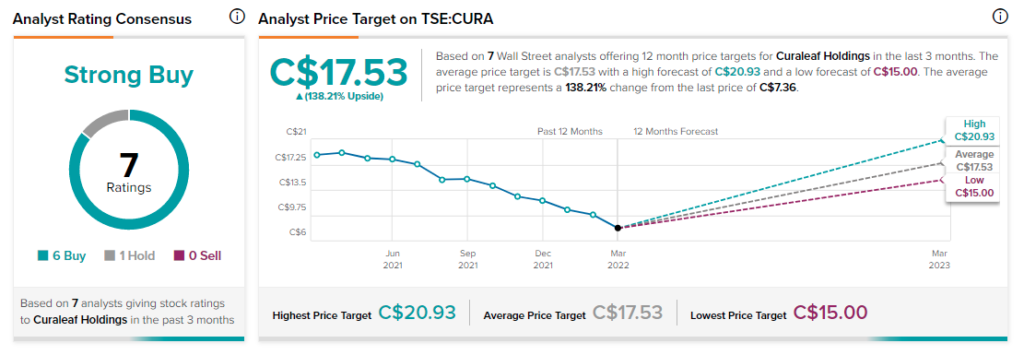

The rest of the Street is bullish on CURA with a Strong Buy consensus rating, based on six Buys and one Hold. The average Curaleaf Holdings price target of C$17.53 implies 138.21% upside potential to current levels.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.