CSX Corporation (CSX) announced that the board has approved a 3-for-1 stock split in the form of a stock dividend. The company provides rail-based freight transportation services.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Per the announcement, each shareholder of CSX as of June 18, will receive a stock dividend of 2 additional common shares for every share held. Trading on a split-adjusted basis will begin on June 28.

The move will make the company’s shares accessible to a larger number of employees and investors.

Notably, the stock split will not have any impact on the quarterly cash dividend of $0.28 per share payable on June 15. Based on the current dividend rate, the post-split quarterly dividend will come to $0.093 per share. (See CSX stock analysis on TipRanks)

In its most recent Q1 earnings report, the company reported adjusted earnings of $0.93 per share, which missed analysts’ expectations of $0.95 per share. However, revenue of $2.81 billion surpassed the consensus estimate of $2.78 billion.

Following the earnings announcement, Cowen analyst Jason Seidl maintained a Hold rating and a price target of $98 (1.6% downside potential).

Seidl commented, “CSX is a good company with solid fundamentals that is well positioned to benefit from long-term economic growth. However, we would remain on the sidelines due to less-than-compelling valuation. The shares may be attractive to patient, long-term investors.”

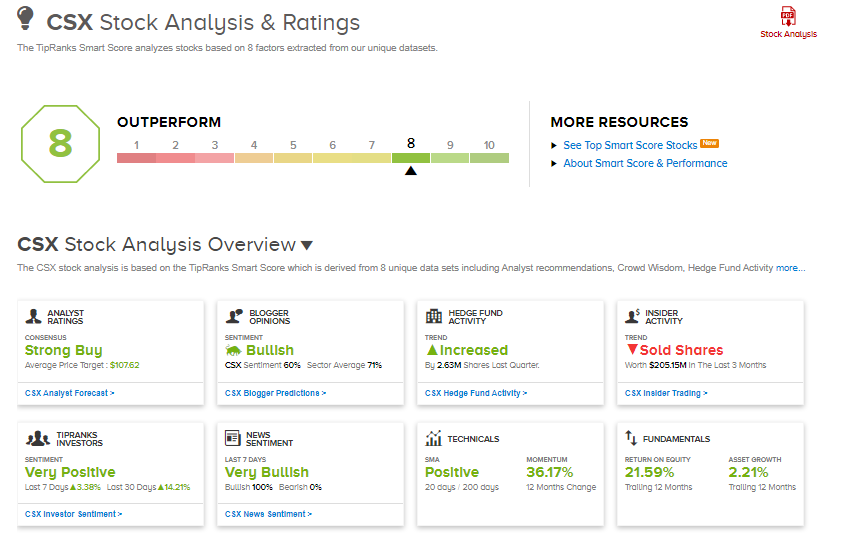

Consensus among analysts is a Strong Buy based on 10 Buys versus 3 Holds. The average analyst price target stands at $107.62 and implies upside potential of 8% to current levels. Shares have gained almost 34% over the past year.

CSX Corporation scores an 8 of 10 from TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform market expectations.

Related News:

DocuSign Gains on Better-than-Expected Q1 Results

Broadcom Reports Better-than-Expected Q2 Earnings on Solid Chip Demand

MongoDB Reports Smaller-than-Expected Q1 Loss, Revenues Beat Estimates