Bitcoin (BTC-USD) rose by nearly 2.34% to $65,468 today amid escalating tensions in the Middle East. Other major cryptocurrencies, such as Ethereum (ETH-USD), Solana (SOL-USD), and Ripple (XRP-USD), also jumped by between 4% and 8% today.

Middle East Tensions

These price gains come after earlier traders scaled back their crypto bets amid the widening conflict between Israel and Iran. On Saturday, BTC had tumbled by as much as 7%. Bitcoin is now down by nearly $8,000 from its March 2024 peak, and a bout of profit-taking could be likely as the much-awaited Bitcoin halving event around April 20 approaches.

Halving Draws Closer

In the past, the halving coincided with a major jump in BTC prices. However, the largest cryptocurrency in the world has already clocked gains of nearly 115% over the past year. The halving lowers the supply of BTC by around half every four years. This year’s event will be the first time that the supply of BTC will be reduced, while demand from crypto ETFs adds a new catalyst to the mix.

Hong Kong Embraces Crypto

Meanwhile, Hong Kong has granted conditional approvals for spot BTC and Ether ETFs. Hong Kong joins other major business hubs, such as Singapore and Dubai, in their quest to become top digital asset hubs. This move also follows approvals for multiple spot-BTC ETFs in the U.S. earlier this year. According to Bloomberg, crypto ETFs in the U.S. have garnered net inflows of around $12.5 billion so far.

Is BTC Expected to Go Up?

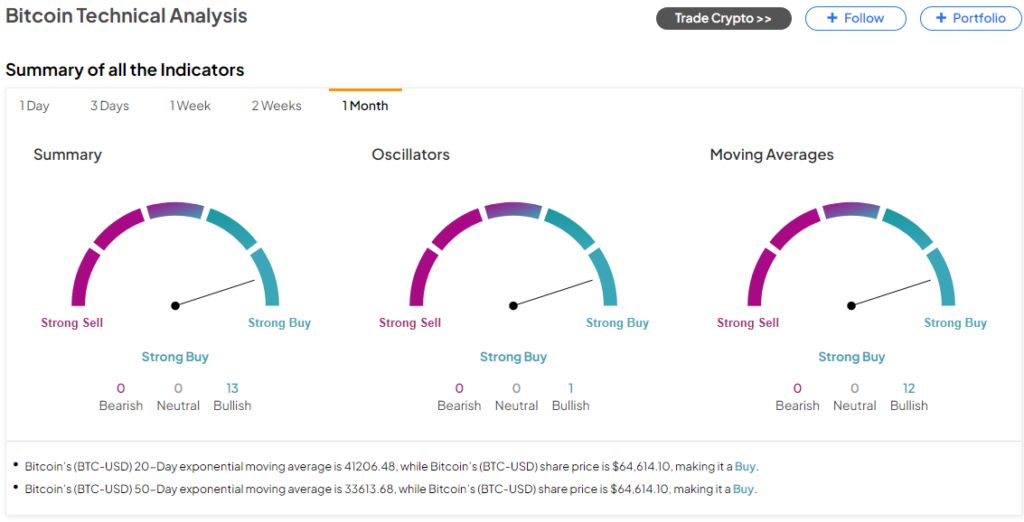

For now, the TipRanks Technical Analysis tool continues to show a Strong Buy signal for Bitcoin. This suggests that the price rally in the cryptocurrency could continue over the coming sessions.

Read full Disclosure