Investors have seen oil company stocks surge by double digits in 2024, prompting them to question the extent of potential upside and consider whether there is an opportunity to join the crude oil bandwagon. These are smart questions considering the oil market has had a bull run in 2024 with crude oil prices having risen 17% to $83 per barrel.

This surge drove the Energy Select Sector (SPDR:XLE) exchange-traded fund (ETF) up by 13% in the first quarter. Notably, the XLE, which includes major oil players like Chevron (NYSE:CVX), Exxon Mobil (NYSE:XOM), and Conoco Phillips (NYSE:COP), serves as a crucial indicator. Importantly, elevated oil prices translate to amplified profits for producers, as each barrel of oil generates higher revenue.

These key players in the oil industry are backed by three significant growth drivers, hinting at sustained investor interest in exploring opportunities within this sector.

International Tensions Driving Oil Price Surge

International dynamics significantly influenced the first-quarter surge in oil prices. Rising oil prices typically translate to increased profits for producers, as higher revenue is earned per barrel while production costs remain relatively stable.

One prominent factor contributing to this trend was Russia’s decision in March to reduce oil production by around 471,000 barrels per day, thereby tightening global oil supply. Analysts, including those at JPMorgan, predict that demand growth will exceed supply, potentially propelling oil prices from $83 to $100 by September.

Robust Economic Growth Drives Oil Demand

Another factor driving oil prices higher is a strong economy. Consumer spending has displayed remarkable resilience, with economists anticipating a further boost to the already robust economic activities. The heightened economic activity contributes to an increase in oil demand. Moreover, there are no immediate signs of a reversal in this trend; in fact, central banks have announced that halting any further interest rate hikes to temper economic acceleration. This robust economic environment unfolds against the backdrop of crude oil inventories standing at approximately 440 million barrels, a level unchanged from the previous year and down from 470 million barrels a year ago, based on data from the U.S. Energy Information Administration (EIA).

Price Per Barrel Technicals Support Oil Stocks

Oil’s technical trends are also encouraging for investors. The price is edging closer to breaking above the midpoint of its range, which has been held between $66 and $120 since as far back as March 2022. A move into the high $80s (currently at $83.10) would increase the likelihood of reaching $100.

Moreover, higher oil prices could potentially drive oil stocks upwards, with producers anticipated to see elevated revenues and earnings if oil production levels remain stable. Even in the absence of a price surge, stocks could still see gains, as analysts project higher oil prices in the future, indicating potentially increased revenues and earnings.

By recognizing and leveraging these trends, investors can strategically position themselves to benefit from the higher oil prices.

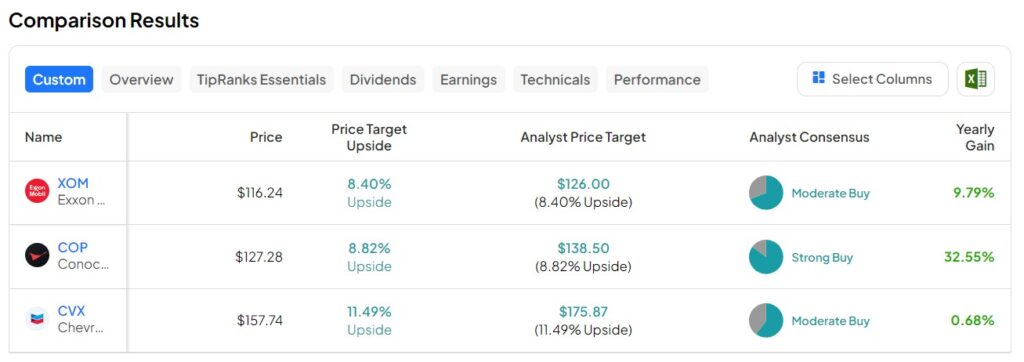

Three oil giants investors may want to explore using the TipRanks Stock Comparison Tool are Exxon Mobil (NYSE:XOM), Conoco Phillips (NYSE:COP), and Chevron (NYSE:CVX). Out of the 3, we can see that the highest average analyst price target is in Chevron stock with an average analyst CVX price target of $175.87, which points to 11.49% upside potential. The analyst consensus for Chevron is a Moderate Buy rating. Interestingly, COP stock has the strongest consensus rating of a Strong Buy.

Key Takeaway

In conclusion, the oil market is poised for further growth in 2024. Investors are scrutinizing the potential for further upside in oil company stocks amid a surge in prices driven by international tensions, robust economic growth, and bullish oil market technical indicators. Analysts foresee opportunities within key players like Chevron (NYSE:CVX), Exxon Mobil (NYSE:XOM), and Conoco Phillips (NYSE:COP), with particularly positive ratings for COP stock.

Investors may want to keep an eye on oil prices and consider the potential impact on oil company stocks as they navigate the market.