Real estate investment trust (REIT) Crown Castle (NYSE:CCI) is on the radar of activist investor Paul Singer-led Elliott Investment Management. The hedge fund has built a stake of over $2 billion in the REIT. As per a Wall Street Journal report, Elliott is seeking to push for board changes and strategic measures at Crown Castle in a bid to improve its share price. CCI stock has lost 21.9% so far this year.

As of date, the market value of Elliott’s stake stands at about $45 billion. The hedge fund could nominate several directors to Crown Castle’s board ahead of its annual shareholder meeting next year. The nomination window will be open between January 18 and February 17. CCI is America’s largest shared communications infrastructure. Its customers include wireless network providers such as AT&T (NYSE:T), T-Mobile (NASDAQ:TMUS), and Verizon (NYSE:VZ). The current macro headwinds have impacted the company’s stock price. These carriers have also reduced spending and expansion plans, ultimately affecting CCI’s income-earning capacity.

Elliott first built a stake in CCI in 2020. It urged the company to revamp the strategy for its fiber business and modify the long-tenure policy for directors. Consequently, the activist investor’s campaign compelled CCI to implement a board retirement policy. Elliott’s plans could be unfolded soon, and it remains to be seen how aggressive its investor campaign proves this time around.

Is CCI a Good Stock?

On November 21, BMO Capital analyst Ari Klein raised the price target on CCI to $95 (8.3% downside potential) from $85 but maintained a Sell rating on the stock. The analyst is encouraged by Crown Castle’s organic growth outlook for Fiscal 2024 but continues to expect the company-specific challenges to persist. As per Klein, increasing leverage and declining AFFO (adjusted funds from operations) per share are taking a toll on the company.

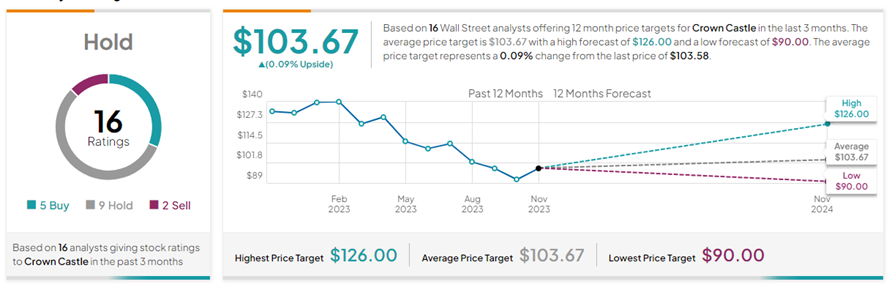

Overall, analysts have a Hold consensus rating on CCI stock based on five Buys, nine Holds, and two Sell ratings. On TipRanks, the average Crown Castle price target of 103.67 implies that shares are fully valued at current levels. CCI pays a regular quarterly dividend of $1.56 per share, reflecting a current yield of 6.04%.