Seemingly, investors can’t go anywhere without hearing about artificial intelligence, particularly generative AI. Once the kinks are worked out, this new wave of digital intelligence promises accelerated productivity. However, it also almost surely promises accelerated vulnerabilities, which is where cybersecurity specialist CrowdStrike (NASDAQ:CRWD) comes into view.

Yes, it’s an obvious narrative: buy CRWD because internet criminals have increasingly worse intentions, and CrowdStrike can help. Obviousness can still be a profitable trait; hence, I am bullish on CRWD stock.

CRWD Stock Is Already Enticing Without Fundamental Catalysts

Before diving into the core of the optimistic narrative for CRWD stock, let’s consider the broader financial framework. Without even getting into the projected dynamics of the cybersecurity arena, which, of course, is an estimation, not a fact – CrowdStrike is already appealing. It’s no surprise that analysts find the company so endearing.

In its most recent earnings report for the fourth quarter of Fiscal Year 2024 (ended January), CrowdStrike posted per-share profitability of 95 cents. This print beat the consensus EPS estimate of 82 cents. On the top line, CrowdStrike posted sales of $845.34 million. This also beat the consensus target of $839.13 million.

Even better, CrowdStrike has been consistent with its EPS performances. In Q3, the company generated per-share profits of 82 cents, beating analysts’ estimate of 74 cents. In Q2, it brought in EPS of 74 cents, exceeding the forecast of 56 cents. Overall, the positive earnings surprise from Q1 through Q4 comes in at a robust 17.65%.

By the end of the current Fiscal year, Wall Street experts believe, on average, that CrowdStrike will print revenue of $3.97 billion. If so, that would represent a nearly 30% increase from last year’s tally of $3.06 billion. And looking out to the next Fiscal year (2026), analysts project consensus revenue to hit $5.01 billion. That would imply a 26.3% year-over-year increase.

Keep in mind again that these are average targets. On the most optimistic end, revenue in Fiscal 2025 could hit $4.06 billion. For Fiscal 2026, this metric could soar to $5.55 billion. These are impressive figures, but what is perhaps the most impressive is the strength of the “weakest link.”

The downside revenue target for the current fiscal year is $3.93 billion. For the following year, it’s $4.88 billion. A 28.4% growth rate in Fiscal 2025 and 24.2% growth in Fiscal 2026? If this is pessimism, it’s a darn bright future for CRWD stock.

CrowdStrike Should Benefit from Cybercrime Vulnerabilities

Looking at the cybersecurity backdrop and its projected reality, the investment narrative for CRWD stock is attractive because, arguably, there’s a greater chance that CrowdStrike will hit the top end of the estimated growth curve.

According to one industry expert, cybercrime could cost the world $8 trillion annually in 2023. That might sound like an outlandish figure, but the estimate doesn’t just involve the direct cost of data breaches. Rather, cybercrime involves the loss of personal and financial data along with critical intellectual property. It also necessarily imposes a heavy cost on productivity and operational disruption. Also, costs exist related to the restoration of hacked data and systems.

Cybercrimes also impose residual damage that’s difficult to quantify, such as reputational harm. If a major company becomes a victim of a data breach, consumers may no longer trust said company, even if it’s truly not the fault of the victimized entity. With so much potential and long-lasting harm that can materialize, CRWD stock seems a no-brainer.

An ounce of prevention is worth a pound of cure. Benjamin Franklin’s words have never been more relevant.

What’s truly frightening – and simultaneously compelling for CRWD stock – is that the above represents known risk factors. However, in the computer coding space, there are rising opinions that generative AI could significantly change the paradigm of the aforementioned discipline. Specifically, AI can help reduce the learning curve of budding computer programmers and accelerate the productivity of established programmers.

Unfortunately, by logical deduction, this innovation also means that programmers can use AI to accelerate nefarious online practices. Further, if economic conditions worsen – especially with rising layoffs in the tech space – there would likely be an increased incentive to engage in dubious activities, boding well for CrowdStrike.

Is CRWD Stock a Buy, According to Analysts?

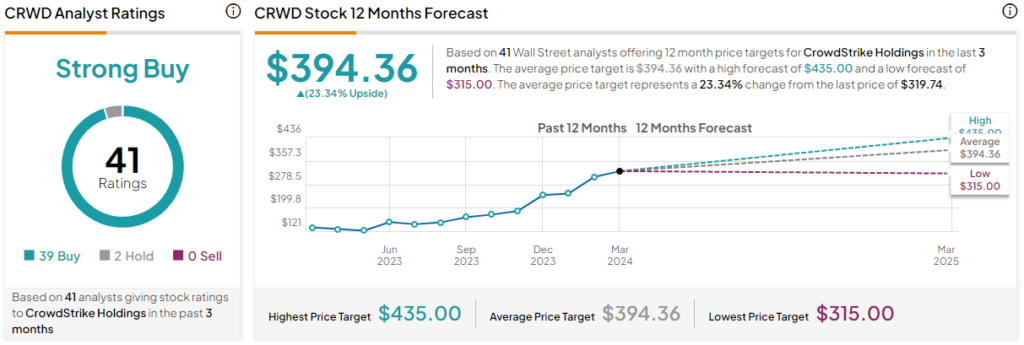

Turning to Wall Street, CRWD stock has a Strong Buy consensus rating based on 39 Buys, two Holds, and zero Sell ratings. The average CRWD stock price target is $394.36, implying 23.3% upside potential.

The Takeaway: An Obvious Play That Can Still Rise

At first glance, CrowdStrike appears to be an extremely relevant but obvious investment. Cybercrimes are rising, and as a result, demand for the company’s services is also rising, which its financials clearly lay out. However, the unknown accelerative potential of generative AI could be the catalyst that sends CRWD stock even higher. Society could be facing grave digital dangers, making CRWD an uncreative but incredibly pertinent bullish market idea.