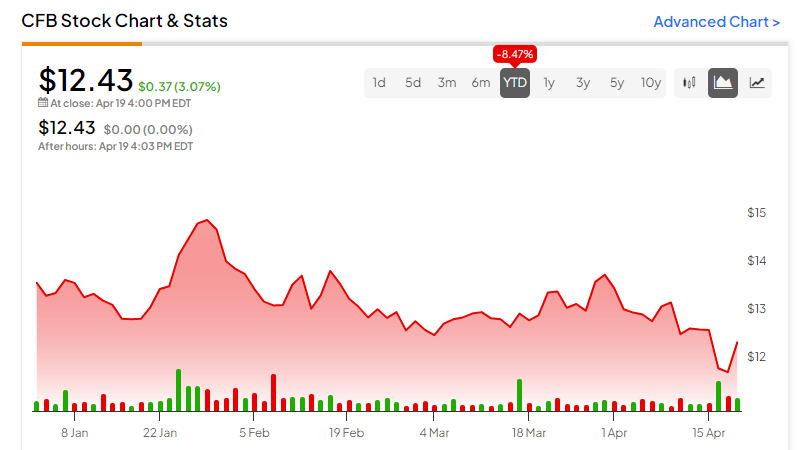

Earnings season thus far has been a mixed bag for banks. Some have reported sharply higher profits, while others are down compared to last year. High interest rates are weighing down banking profits, particularly for regional players like CrossFirst Bankshares (NASDAQ:CFB). Despite a solid quarterly financial report, the bank’s stock has fallen over 8% this year. However, investors interested in a regional bank stock with promising long-term growth may want to take a closer look.

CrossFirst Bankshares’ Light Footprint

CrossFirst Bankshares is a registered bank holding company offering numerous financial products and services to businesses, professionals, individuals, and families. Headquartered in Leawood, Kansas, CFB has an extensive presence in seven states.

CrossFirst Bankshares’ business model is strategically designed to be branch-light, with only 15 full-service locations strategically placed in robust markets. This unique approach, coupled with its diverse specialty industry verticals, including sponsor finance, financial institutions, restaurant finance, energy, and small business (SBA), positions the bank for potential growth.

CFBs Recent Financials

CrossFirst’s first quarter report indicates solid performance. The company registered revenue of $62.2 million, falling just short of consensus expectations of $63.28 million. Net income of $18.2 million delivered earnings per share (EPS) of $0.36, which surpassed the consensus estimation of $0.34.

The bank demonstrated significant financial stability and growth potential in the first quarter. It reported organic loan and deposit growth, stable credit quality, expanded non-interest income, and an overall rise in earnings. Further adding strength to this performance, the total assets for the quarter grew to a record $7.5 billion. Total loan growth was $121 million, a quarterly growth rate of 2%.

What Is the Price Target for CFB?

The bank stock has been trending downward, posting a -8.5% return YTD, and it continues to demonstrate negative price momentum trading below the 20-day (12.81) and 50-day (12.99) moving averages. The shares appear fairly valued, with the P/B ratio of 0.81x in line with the Regional Banks industry average of 0.84x.

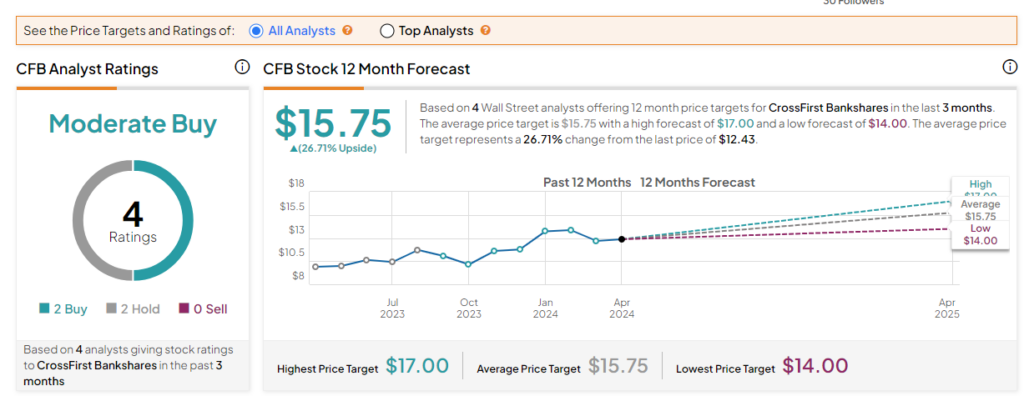

Analysts covering the bank have been cautiously optimistic about the stock. For instance, Stephens analyst Matt Olney has reduced the price target for CrossFirst Bancshares from $18 to $17, but maintains an Overweight rating on the shares. He cites substantial loan and deposit growth in Q1 as indicative of ongoing positive expectations.

CrossFirst Bankshares is rated a Moderate Buy based on the recommendations and 12-month price targets that four Wall Street analysts have issued in the past three months. The average price target for CFB stock is $15.75, which represents a 26.71% upside from current levels.

Final Thoughts on CFB

In a period of volatile economic performance for banks, CrossFirst Bankshares has emerged as a relatively steady player in the banking sector. Its strategic ‘branch-light’ business model and numerous financial services position it favorably for future growth, despite fluctuating interest rates and challenging market circumstances. The continued growth in critical areas such as organic loans and deposits, along with an overall rise in earnings, underpin the bank’s resilience and prospective profitability. CrossFirst Bankshares’ financial stability and strong performance could therefore make it an investment option worthy of consideration.