Online sports betting platform DraftKings (NASDAQ:DKNG) has faced some troubles lately, and investors aren’t particularly happy about it. Now, it’s calling out a former executive and taking said exec to court over allegations of corporate espionage. As a result, shares are down fractionally in Friday afternoon’s trading.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

DraftKings is suing Michael Hermalyn, who previously served as DraftKings’ senior vice president of business development. Hermalyn moved to Fanatics VIP, a competing firm, where he was to serve as president, reporting directly to the CEO, billionaire Michael Rubin. DraftKings asserts that Hermalyn took “corporate secrets” with him and is actively working to poach some of DraftKings’ most valued customers.

Given that sports bettors are well known for dropping one platform in favor of another based on something so simple as the value of a promotional deal, knowing those customers could be valuable. Fanatics, meanwhile, asserts that DraftKings operates under “…a culture of retribution” and wants to “…instill fear…” in other employees looking to make a move.

Abandon Ship

This might be more prescient than most realize at first glance. After all, since 2021, 186 DraftKings employees applied for positions with Fanatics. That’s a substantial number of potentially lost employees, which would leave DraftKings on the back foot. Worse, since DraftKings is already generally considered the number two platform behind FanDuel, it can ill afford anything that might make it look weak. But aggressively pursuing legal action against employees who do leave might not be the way to go here.

What Will DraftKings Stock Be Worth?

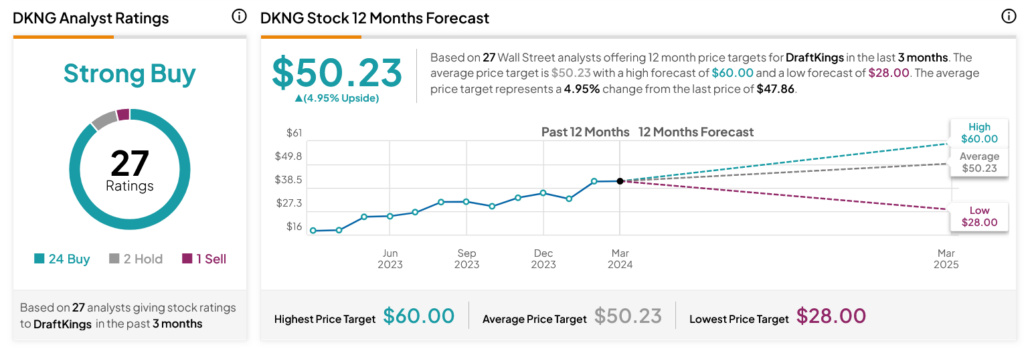

Turning to Wall Street, analysts have a Strong Buy consensus rating on DKNG stock based on 24 Buys, two Holds, and one Sell assigned in the past three months, as indicated by the graphic below. After a 174.14% rally in its share price over the past year, the average DKNG price target of $50.23 per share implies 4.95% upside potential.