There’s a reshuffle taking place in the DraftKings (NASDAQ:DKNG) C-suite. On Monday, the sports betting giant said that as of May 1, CFO Jason Park will become the company’s Chief Transformation Officer, a newly created role.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Park came on board as CFO in 2019, guiding the company through its move to the public markets, and he is anticipated to spearhead efforts aimed at seizing further operational efficiencies, while also supervising the integration of lottery app Jackpocket into the company following its proposed acquisition.

At the same time, Senior Vice President of Finance and Analytics Alan Ellingson has been promoted to the position of CFO. Per management, he has collaborated closely with Mr. Park over the course of his four-year tenure, with the pair working on various projects together.

In Canaccord analyst Michael Graham’s view, the changes come across as an “orderly and sensible transition” of responsibilities for Park, with the new role enabling him to “drive incremental improvements to the company’s profitability” in the years ahead. “We continue to find shares of DKNG attractive at current levels, as investments the company has made in its human capital, brand, and product offering have built a solid foundation for strong growth and margin expansion as the US digital gaming market matures,” said Graham, who ranks in the top 3% of Street stock experts.

Accordingly, the 5-star analyst reiterated a Buy rating on DKNG shares along with a $54 price target, suggesting room for growth of ~17% over the 12-month timeframe. (To watch Graham’s track record, click here)

Jefferies analyst David Katz is just as positive about the changes. “Our impression is that Jason Park has experience with operational roles before, and given the timing of the pending Jackpocket acquisition, the transition seems appropriate,” said the analyst, who also notes that since Ellingson has played a significant role in constructing the company’s guidance and long-term forecasts, there should be continuity in philosophy and outlook, even though he has had “limited Street-facing engagement.”

All in, there’s no change to Katz’s thesis, who maintains that DKNG is a “leader in the digital space and will maintain its approximate share levels despite increasing competition and market evolution.”

Katz also rates DKNG a Buy while his $52 price target implies shares have room to climb 12% higher over the coming months. (To watch Katz’s track record, click here)

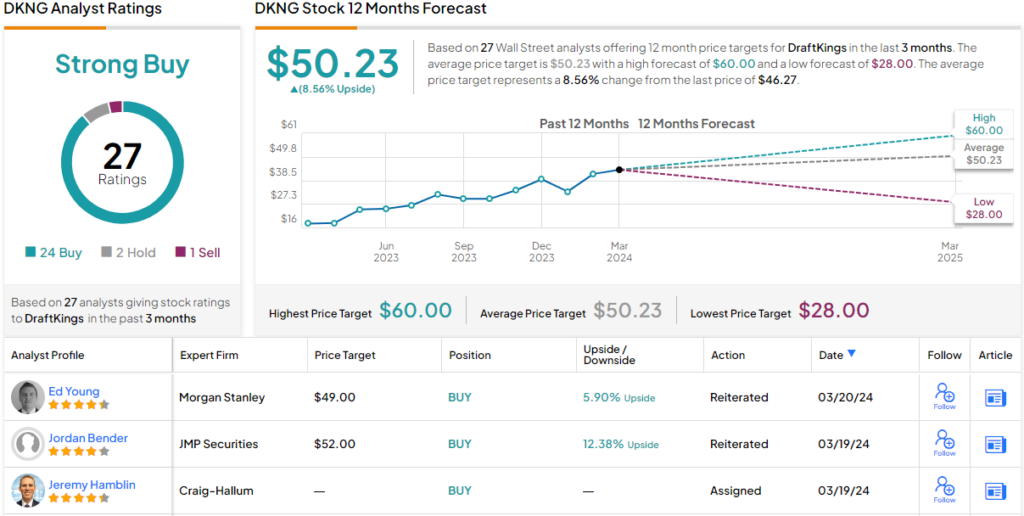

Overall, barring 2 Holds and 1 Sell, all 22 other recent analyst reviews are also positive, making the consensus view on DKNG a Strong Buy. The forecast calls for one-year returns of 15%, considering the average target clocks in at $50.23. (See DraftKings stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.