Cowen & Co. upgraded Domino’s Pizza to Buy from Hold and lifted the stock’s price target to $450 (14.2% upside potential) from $445. Shares of the pizza delivery chain closed 1.5% higher on Friday after the rating change.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Cowen analyst Andrew Charles believes that Domino’s Pizza (DPZ) has room for multiple expansion. “Domino’s off-premise oriented, digitally-led (75% of 2Q20 sales) business model has executed strongly through the first 6 months of COVID-19. In our view, DPZ is implementing a successful LT (long term) playbook to help extend the brand’s success. These tactics include menu & technological innovation, expanded value offerings and an ad fund that grows in-line with the U.S.’ robust sales growth,” Charles wrote in a note to investors.

The 5-star analyst further added that “We model upside to 2020-22 U.S. comps & EPS given proactive measures executed to advance DPZ’s position of strength brought about by COVID-19. We expect share gains from the 51% of the QSR (quick service) pizza category comprised of regionals + independents.” (See DPZ stock analysis on TipRanks).

In mid-July, Domino’s Pizza reported upbeat 2Q earnings and revenues. Earnings of $2.99 per share surpassed Street estimates of $2.24 per share, while 2Q revenues of $920 exceeded analysts’ expectations of $915 million.

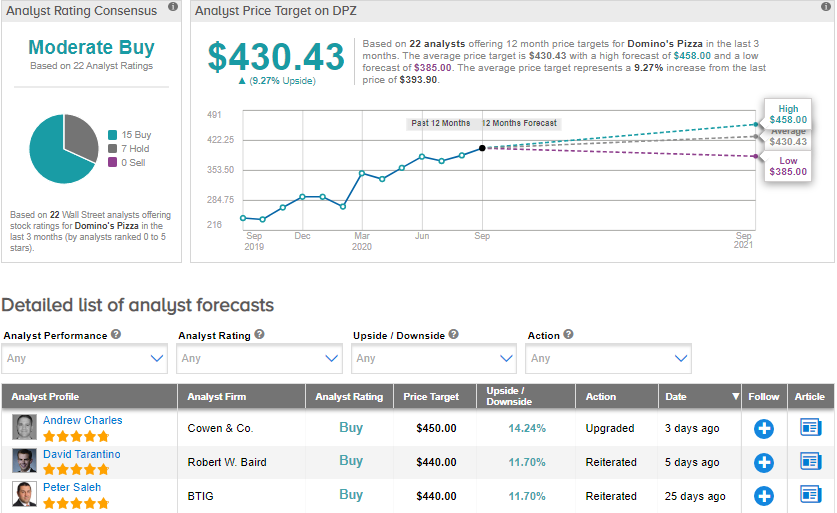

Currently, the Street has a cautiously optimistic outlook on the stock. The Moderate Buy analyst consensus is based on 15 Buys and 7 Holds. The average price target of $430.43 implies upside potential of about 9.3% to current levels. Shares have gained 34.4% year-to-date.

Related News:

Nvidia To Buy Softbank’s Arm Holdings For $40B

ByteDance To Join Up With Oracle, To Abandon TikTok US Sale – Report

Buffett’s Berkshire Divests Shares In Liberty Global, Axalta Coating