The massive surge seen in Bitcoin (BTC-USD) lately has given a lot of extra life to crypto stocks all up and down the spectrum. However, crypto exchange Coinbase (NASDAQ:COIN) got its own life cut short today as a reversal in court proved a reversal for the stock as well. Shares were down over 2% in Wednesday afternoon’s trading following a hit from the Securities and Exchange Commission (SEC) itself.

A lawsuit from the SEC hit Coinbase, and it’s already in progress. It’s not going especially well for Coinbase, either, as a judge found that the SEC’s claim that Coinbase engaged in “unregistered sales of securities” could indeed be heard by a jury when the case goes to trial. Coinbase attempted to have that notion dismissed, but the judge wasn’t having it.

The lawsuit dates back to June when the SEC alleged that Coinbase was “…acting as an unregistered broker and exchange.” However, the news wasn’t all bad: the SEC’s claim that Coinbase was acting as an unregistered broker through its Wallet application was dismissed.

More Trouble Ahead

Coinbase took a hit over its staking program. Staking is when a cryptocurrency holder locks tokens in a blockchain network, which earns said holder rewards, almost like interest. This, coupled with the recent issues over the KuCoin operation (KCS-USD), is putting some pressure on the whole cryptocurrency market.

However, some analysts are warning that Bitcoin itself may be setting up for a short squeeze thanks to the growing discrepancy between institutions and hedge funds. Hedge funds are holding a hefty bill of short contracts, noted a Kitco report, while institutions had a substantial supply of longs.

Is Coinbase a Buy, Sell, or Hold?

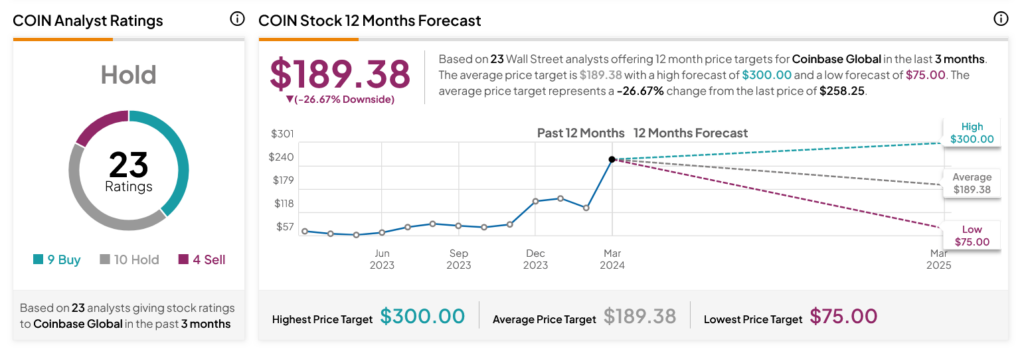

Turning to Wall Street, analysts have a Hold consensus rating on COIN stock based on nine Buys, 10 Holds, and four Sells assigned in the past three months, as indicated by the graphic below. After a 313.10% rally in its share price over the past year, the average COIN price target of $189.38 per share implies 26.67% downside risk.