Earlier today, Converge Technology Solutions (TSE: CTS), a Canadian Hybrid IT infrastructure company, reported its Q3-2022 results. Converge’s results beat earnings-per-share (EPS) estimates but lagged revenue expectations. Nonetheless, the company is growing at a rapid pace.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Converge Technology’s revenue rose to C$603.2 million (a 64% year-over-year increase, which missed expectations of C$610.8 million. The company’s gross revenue experienced an organic growth rate of 5.9%, highlighting that CTS mainly grows through acquisitions. Interestingly, its gross profit margin increased to 23.2% from 22.8% last year.

Additionally, its adjusted earnings per share were C$0.10, greater than the C$0.07 consensus estimate and 43% higher than the C$0.07 from last year. Also, the company’s adjusted EBITDA rose 64% year-over-year, the same as the revenue growth rate, to C$30.97 million.

Regarding adjusted free cash flow for the quarter, it came out to C$24.7 million compared to C$15.5 million in the same period last year. For the first nine months of the year, adjusted free cash flow was C$82.7 million.

Lastly, Converge’s product bookings backlog fell from C$507.4 million to C$432.8 million quarter-over-quarter due to hardware supply chain improvements.

Is CTS a Good Stock to Buy, According to Analysts?

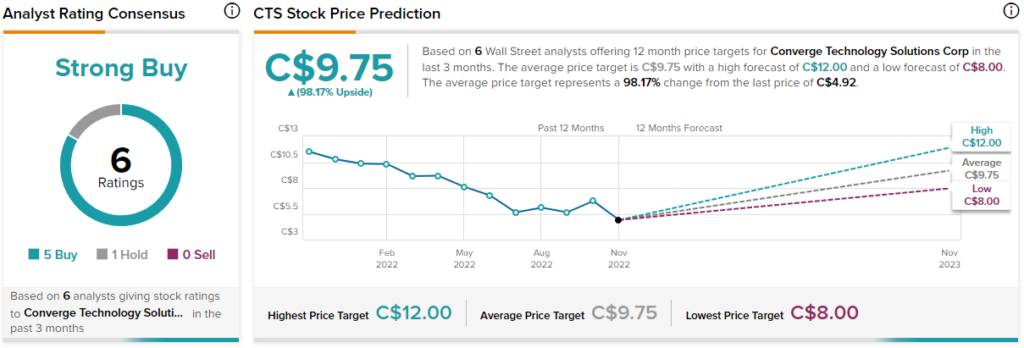

Analysts are very optimistic about Converge Technology. CTS stock earns a Strong Buy consensus rating based on five Buys and one Hold rating assigned in the past three months. The average CTS stock forecast of C$9.75 implies 98.2% upside potential.

Conclusion: Converge Technology is Growing Quickly and Profitably

Although Converge Technology reported a mixed quarter, the overall result is quite solid, as the company’s revenue and profitability are both growing quickly while maintaining positive organic growth.