ContextLogic (NASDAQ:WISH) has broken the hearts and accounts of many brave buyers, but some might actually break even on the stock now after its large rally earlier today. That’s fortunate, yet it’s not necessarily a sign that ContextLogic is on the cusp of a turnaround. When all is said and done, I am neutral on WISH stock, and I wouldn’t dare to buy or short-sell it.

ContextLogic operates a miniature version of Amazon (NASDAQ:AMZN), which is called Wish.com and which the company describes as “one of the world’s largest mobile ecommerce platforms.” Furthermore, like Amazon, ContextLogic also runs a logistics business.

Yet, ContextLogic really doesn’t belong in the same category as a mega-success like Amazon. Wish.com’s products, to be brutally honest, are cheap and may be of less-than-stellar quality. Still, there may be a niche audience for this type of business – but then, a closer look at ContextLogic’s stats and developments should make prospective WISH stock investors extremely wary.

ContextLogic: The Big Talk and the Real Data

When you read enough corporate press releases, you start to see through the positive spin and the big talk. In the case of ContextLogic, there’s certainly big talk, but the data will tell the real tale of what’s happening with the company.

For example, ContextLogic proudly announced the launch of WishPost Smart Parcel, a small parcel delivery service. The press release calls this an “innovative service,” but to me, it sounds similar to what Amazon’s logistics arm is already doing quite successfully.

In another example, ContextLogic CEO Joe Yan boasted that his company “closed the third quarter with revenue in-line with our expectations and adjusted EBITDA above the high end of our guidance.” Sure, that’s true, but is it really much of an accomplishment if a company exceeds a low set of expectations?

Here’s the rundown. In 2023’s third quarter, ContextLogic’s revenue sank 52% year-over-year to $60 million. Meanwhile, the company’s adjusted EBITDA was -$54 million, and ContextLogic’s quarterly free cash flow (FCF) totaled -$86 million.

Turning to the bottom line, ContextLogic’s Q3-2023 earnings indicated a net loss of $3.35 per share. For what it’s worth, that’s better than the company’s net loss of $5.53 per share in the year-earlier quarter. Yet, it’s still a pretty dismal result, wouldn’t you agree?

There’s more to this story, though. Almost as an afterthought, ContextLogic’s Q3-2023 press release mentioned that the company “initiated a process to explore a range of strategic alternatives to maximize value for Wish shareholders.” That’s certainly more than an afterthought, though, as it left the unanswered question of exactly what ContextLogic’s management had in store.

A Relief Rally and an Uncertain Future

On Monday, we finally got an idea of what ContextLogic’s “strategic alternative” might be. In particular, ContextLogic disclosed its “agreement to sell substantially all of its operating assets and liabilities, principally comprising its Wish ecommerce platform, to Qoo10.”

In case you’re wondering, Qoo10 is an Asian e-commerce platform, and the sale of ContextLogic’s assets/liabilities will be for $173 million. Upon hearing this news, the market sent WISH stock 39% higher on Monday.

Clearly, this is a relief rally. ContextLogic’s previous “strategic alternative” announcement could have meant a number of things, including bankruptcy proceedings. At least, it appears that ContextLogic won’t have to take that path.

There’s also a sense of relief for the current shareholders because ContextLogic’s press release specified, “If the ContextLogic Board does not identify opportunities that will allow it to effectively monetize the value of its [net operating losses] to the benefit of shareholders, it intends to promptly return all capital to shareholders.” Thus, current WISH stockholders probably aren’t in grave danger of losing the entire value of their investment.

So, if you’re a current ContextLogic shareholder, it’s understandable if you’re somewhat relieved. None of this means that it’s wise to take a new share position in ContextLogic, though. At this point, ContextLogic’s future is too unclear to apply any meaningful analysis or form a confident investment plan.

Is WISH Stock a Buy, According to Analysts?

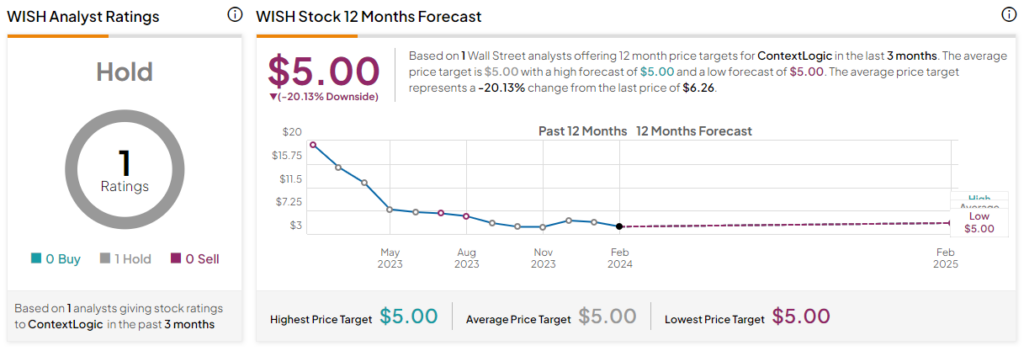

On TipRanks, WISH comes in as a Hold based on one Hold rating assigned in the past three months. WISH stock’s price target is $5, implying 20.1% downside potential. However, this price target is from one month ago.

Conclusion: Should You Consider WISH Stock?

There are knowns and unknowns about ContextLogic. What’s known from the data isn’t encouraging. What’s unknown is ContextLogic’s next steps and what investors should expect.

Sure, it’s exciting to watch ContextLogic stock shoot 39% higher in a single day. It’s hard to know where the stock might go from here, though. After all, relief rallies can fizzle out quickly.

All of this uncertainty makes it difficult for investors to apply an action plan. Currently, it just doesn’t make a lot of sense to consider a new position in WISH stock. If you were already invested and managed to achieve breakeven or a profit, consider yourself lucky, and, as the old saying goes, take the money and run.