Beverage and alcohol company and home of Modelo and Corona brands, Constellation Brands (NYSE:STZ), announced its fiscal third quarter results today. The company reported adjusted earnings of $3.19 per share, compared to $2.83 per share in the same period last year. Analysts were expecting adjusted earnings of $3.01 per share.

The company’s net sales increased by 1.2% year-over-year to $2.47 billion but fell short of Street estimates of $2.54 billion. Constellation Brands’ beer business achieved “strong high single-digit depletion growth” and a strong rise in its net sales “primarily driven by continued momentum of the Modelo brand family.”

The company’s beer business saw net sales growth of 4% year-over-year to $1.96 billion. STZ also declared a quarterly cash dividend of $0.89 per share of Class A stock.

Looking forward, Constellation Brands raised its FY24 earnings outlook and now expects earnings to land between $9.15 and $9.35 per share. The company reiterated its comparable earnings guidance, excluding its Canopy equity investment, and anticipates it to be between $12 and $12.20 per share.

The company also raised its FY24 operating cash flow target to between $2.6 billion and $2.8 billion, and its free cash flow projection is from $1.4 billion to $1.5 billion. For reference, its prior forecast was $2.4 billion to $2.6 billion for the former and between $1.2 billion and $1.3 billion for the latter.

Should I Buy or Sell STZ?

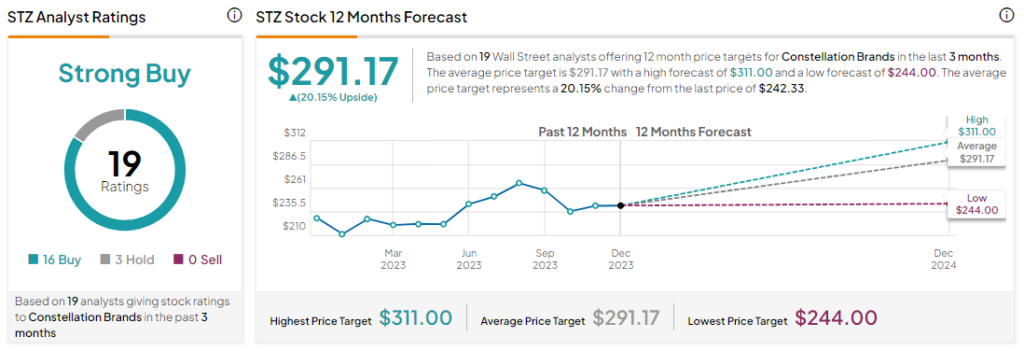

Analysts remain bullish about STZ stock with a Strong Buy consensus rating based on 16 Buys and three Holds. Over the past year, STZ stock has gone up by 15%, and the average STZ price target of $291.17 implies an upside potential of 20.2% at current levels.