Beer giant and home of the Corona brand, Constellation Brands (NYSE: STZ) reported strong Fiscal second-quarter earnings. The company swung to a profit in the second quarter with earnings of $3.74 per share as compared to a loss of $6.30 in the same period last year. This surpassed analysts’ expectations of earnings of $3.37 per share.

Sales increased by 6.8% year-over-year to $2.837 billion as compared to Street estimates of $2.82 billion. The company’s beer business continued to be strong with its net sales and operating income both growing in double-digits. Constellation’s beer brand, Modelo continued to gain momentum and showed a “high-single digit depletion growth” in Q2.

As a result, the company has raised its FY24 outlook and now expects its earnings to range from $9.60 to $9.80 per share while comparable earnings are likely to be between $12.00 and $12.20 per share. STZ reiterated its FY24 target for operating cash flows and anticipates it to be in the range of $2.4 billion to $2.6 billion while free cash flow is projected to be between $1.2 billion and $1.3 billion.

Constellation has declared a quarterly dividend of $0.89 per share of Class A Common Stock payable on November 17 to shareholders of record as of the close of business on November 3, 2023.

Is STZ a Buy Hold or Sell?

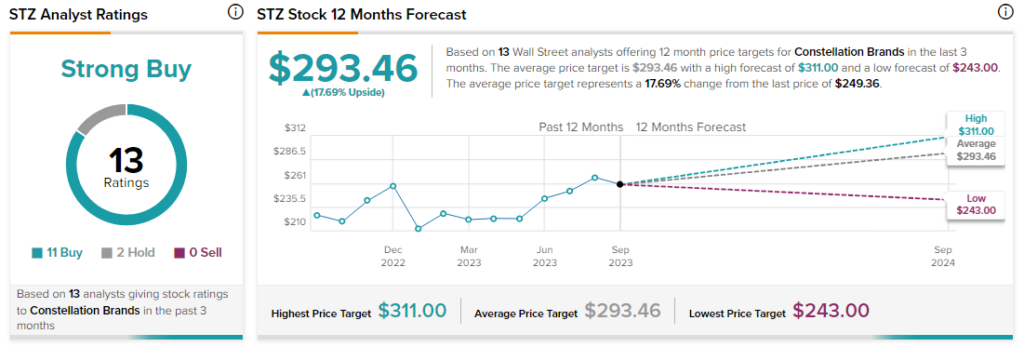

Overall, Wall Street analysts are bullish about STZ stock with a Strong Buy consensus rating based on 11 Buys and two Holds.