Earlier today, ConocoPhillips (NYSE:COP) released its earnings report, and this oil stock managed to deliver wins. Earnings proved a beat, and production soared. That was good enough for investors, as shares were up just over 1.5% in Thursday morning’s trading.

ConocoPhillips’ earnings per share in the fourth quarter came in at $2.40 per share, which beat analyst projections of $2.09 per share. Production improved significantly, with a total of 1,902 million barrels of oil equivalent per day (MBOED), up 144 MBOED from what it was at the end of 2022’s fourth quarter.

ConocoPhillips’ biggest win came from the Lower 48, which brought in 1,086 MBOED. The Permian Basin came in second at 750 MBOED, while Eagle Ford put up 211 MBOED, and the Bakken Shale brought out 110 MBOED. While the average price fell from $71.05 in 2022’s fourth quarter to the current $58.21, the huge upswing in production made up for that loss.

Geopolitics Played a Hand

The recent—and still ongoing—Israel-Hamas war is driving pricing action as well. With the latest ceasefire overtures rejected, oil prices are on the rise once more as the region proves increasingly unstable and the Red Sea continues to be a target for Houthi rebels in Iran. That’s sending a lot of cargo down around the Cape of Good Hope, a significantly longer trip. There are even some signs that demand is starting to make a comeback, even as supply issues are starting to kick in.

Is ConocoPhillips a Buy, Sell, or Hold?

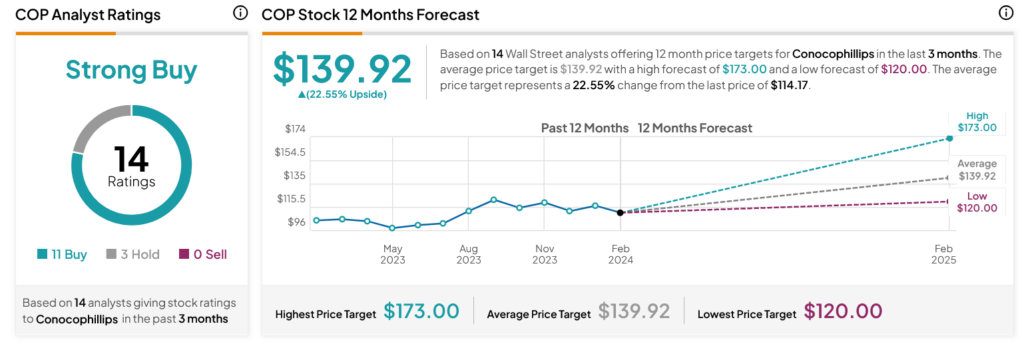

Turning to Wall Street, analysts have a Strong Buy consensus rating on COP stock based on 11 Buys and three Holds assigned in the past three months, as indicated by the graphic below. After a 7.47% rally in its share price over the past year, the average COP price target of $139.92 per share implies 22.55% upside potential.