Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

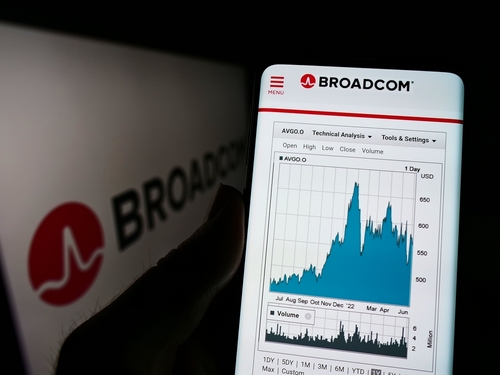

Gamco Investors, Inc. ET AL, managed by Mario Gabelli, recently executed a significant transaction involving Broadcom Inc. ((AVGO)). The hedge fund reduced its position by 44,691 shares.

Recent Updates on Broadcom Inc. stock

Recent developments for Broadcom Inc. (AVGO) include the launch of Emulex Secure Fibre Channel Host Bus Adapters and the Brocade G710 24-port 64G switch, emphasizing data encryption and Fibre Channel technology. Despite these innovations, Morgan Stanley lowered Broadcom’s price target from $265 to $246, citing concerns over AI developments like DeepSeek, while Barclays raised its target to $260, maintaining optimism for Broadcom’s prospects in AI and semiconductors. Notably, there was bullish options activity with increased call trading and implied volatility, reflecting market optimism ahead of expected earnings on March 6th. The company’s year-to-date price performance is 1.32%, with a current market cap of $1101.7 billion.

More about Broadcom Inc.

YTD Price Performance: 1.65%

Average Trading Volume: 32,993,032

Current Market Cap: $1105.3B