It was a move that had been a long time in coming. Entertainment giant Warner Bros. Discovery (WBD) lost a lot of its NBA credibility when games stopped airing on TNT. And now, one of the last connections left between the sports giant and the entertainment kingpin has also passed as the NBA now has full control of NBA TV. The move did not concern investors much, and shares ticked up modestly in the closing minutes of Tuesday’s trading.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The NBA recently revealed a slate of live games and original programming, that will go on the NBA TV channel as well as on the NBA App, which itself was recently redesigned. Warner gave up “operational control” over the app and the channel, which it had since 2008, reports noted. This comes at about the same time that Warner will also lose access to the games that will be going out over a whole new coalition of content providers.

The NBA will also be bidding farewell to NBA Gametime Live, which will be replaced with The Association, featuring hosts John Wall, Chris Haynes, Rudy Gay, David Fizdale and MJ Acosta-Ruiz. The NBA plans to bring 60 regular-season games to the 2025-2026 run, which will start October 25. Sara Zuckert, the Senior Vice President of the NBA and the Head of the NBA app, noted, “NBA TV and the NBA App are designed to be a connected, global hub for basketball coverage, delivering nonstop access to live games, original programming and exclusive behind-the-scenes content. The NBA app streaming platform will provide a seamless, always-on digital experience for fans to access 24 hours a day, 365 days a year.”

What a Deal Means to You

With a growing number of potential buyers kicking the tires on Warner, some have started to wonder just what such a move means for consumers. Besides the obvious, of course, of one less platform to subscribe to, such a move would mean that someone is about to go up in the world. And be a lot more attractive to consumers in the process.

HBO Max is the fourth most popular streaming service in the United States, reports note. This in turn makes it a substantial boost to anyone who buys it, offering up a wide array of content that spans decades of development. For some, it would mean a securing of position. For others, a faster—and probably shorter—route to the top. With that in mind, it is little wonder that so many firms are taking an interest in Warner these days.

Is WBD Stock a Good Buy?

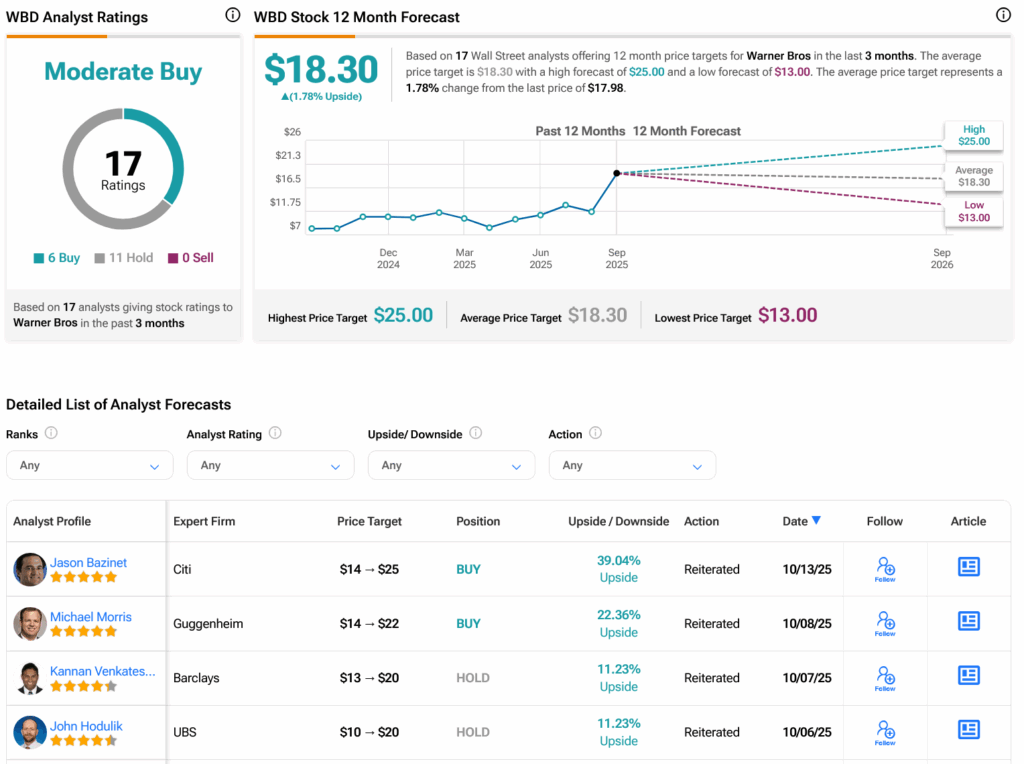

Turning to Wall Street, analysts have a Moderate Buy consensus rating on WBD stock based on five Buys and 11 Holds assigned in the past three months, as indicated by the graphic below. After a 133.95% rally in its share price over the past year, the average WBD price target of $17.82 per share implies 1.78% upside potential.