Apparel company Columbia Sportswear (NASDAQ:COLM) did not have a great fourth quarter. That much is clear from its earnings report. However, insult was added to injury as analysts took one look at the fourth quarter and offered up opinions that weren’t complimentary. Columbia lost nearly 5% in the closing minutes of Monday’s trading. This is the second day running that Columbia is down, and mostly, it’s thanks to UBS.

UBS analysts Jay Sole and Mauricio Serna offered up a report that kept Columbia’s rating where it was: a Sell. Worse, they not only maintained the rating but also lowered the price target to $59 per share. UBS basically expects share prices to drop about 28% against what they were on Friday. While Columbia has plenty of solid products to its credit, the analysts noted, the consumer was a bit less likely to pick any of it up, which means a damaged bottom line accordingly.

More Trouble Coming

The fourth quarter report from Columbia revealed nothing especially helpful, as it looks for 2024 to be marked by an “…erosion in profitability.” That comes as Columbia faces more competition in the outdoor apparel market while retail partners become more selective about which products they’ll carry due to declining consumer spend.

Is Columbia Stock a Buy?

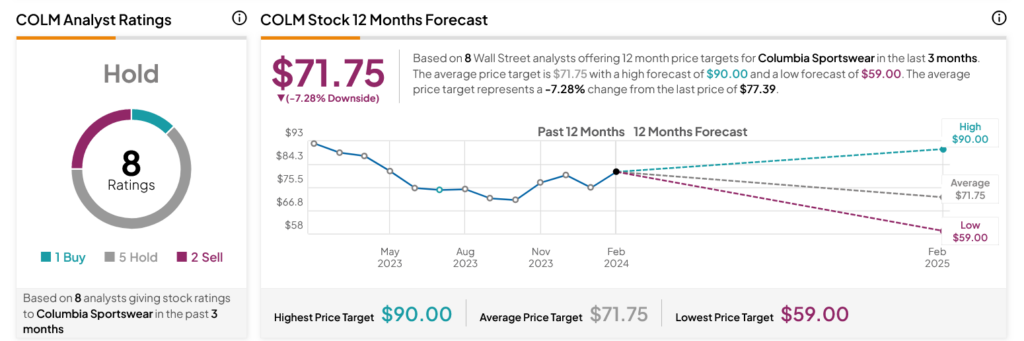

Turning to Wall Street, analysts have a Hold consensus rating on COLM stock based on one Buy, five Holds, and two Sells assigned in the past three months, as indicated by the graphic below. After a 13.78% loss in its share price over the past year, the average COLM price target of $71.75 per share implies 7.28% downside risk.