Normally, these days, high school is regarded as little more than a stepping stone to something bigger. Usually that something is college, though trade schools are starting to make a bit of a comeback. Big data stock Palantir Technologies (PLTR), however, sees high school as something different: a source of fresh talent. The move may be unexpected, but investors were enthusiastic, sending Palantir shares up nearly 1.5% in Monday morning’s trading.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Palantir laid out its position bluntly: “College is broken. Admissions are based on flawed criteria. Meritocracy and excellence are no longer the pursuits of educational institutions.” Thus, Palantir started up what it calls the Meritocracy Fellowship, started using CEO Alex Karp’s basic theory that college, as it stands, is not providing what the labor market needs.

The program drew plenty of noteworthy subjects. Some did not find college of much interest. Others were rejected from their schools of choice. And now, Palantir has 22 high school graduates coming on board to work full-time, assuming they clear a single hurdle: reasonable success in a four-week seminar program. The program includes case studies of world leaders and the foundations of Western civilization. Upon completion, the students became “forward-deployed engineers” who travel to client locations to handle issues.

Suing the Older Ones

Meanwhile, recently, Palantir took on two of its former engineers over matters of confidential documents. The engineers, Palantir alleged in federal lawsuit filings, were planning to open a “copycat” company that would have directly competed with Palantir. The company in question is known as Percepta, owned by General Catalyst, a major venture capital firm.

Palantir alleges the engineers in question were trusted with a range of powerful tools, including Palantir source code, workflows for customer deployments, and “proprietary customer engagement strategies.” Palantir notes these represented “…billions of dollars in investment.” Palantir is seeking reimbursement of its legal fees, “emergency injunctive relief,” as well as an extension of the non-compete clauses in the engineers’ contracts.

Is Palantir a Good Stock Buy?

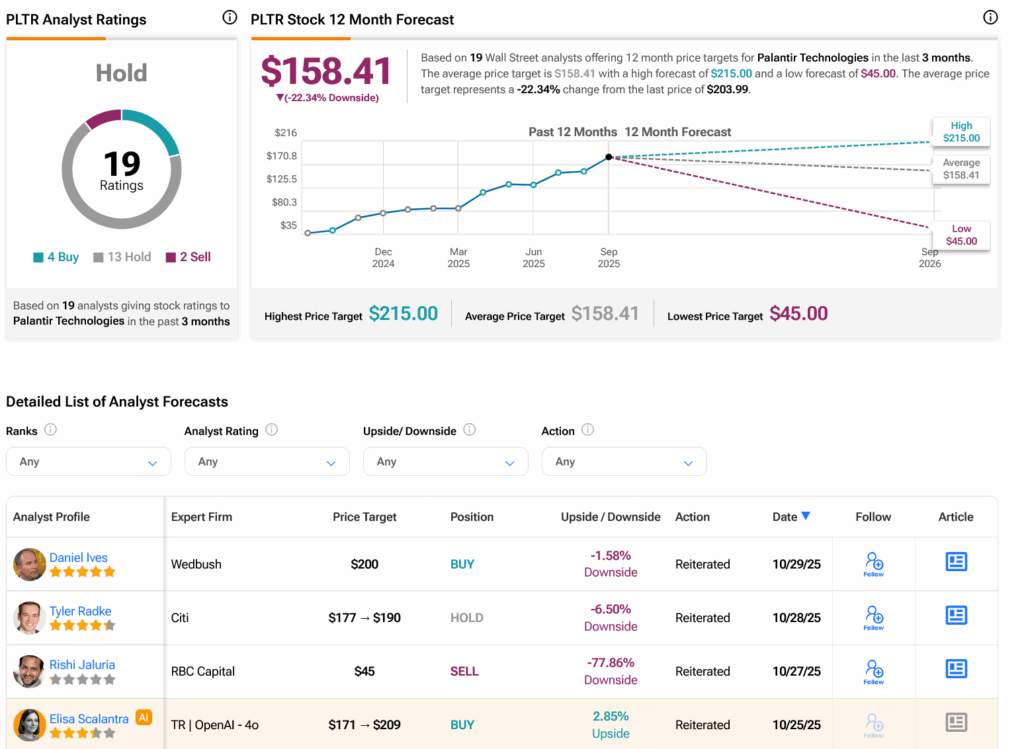

Turning to Wall Street, analysts have a Hold consensus rating on PLTR stock based on four Buys, 13 Holds and two Sells assigned in the past three months, as indicated by the graphic below. After a 384.11% rally in its share price over the past year, the average PLTR price target of $158.41 per share implies 22.34% downside risk.