When evaluating potential options trading ideas, Colgate-Palmolive (CL) would likely rank low on most retail traders’ lists. It’s not a play on data centers, artificial intelligence, or cryptocurrencies. As a consumer goods stalwart, Colgate seems almost pedestrian by comparison. Yet, this very profile makes CL stock far more predictable than many of its flashier peers.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

For options traders, that predictability carries a premium of its own. Sure, chasing the next breakthrough in quantum computing or some other revolutionary innovation sounds exciting. But such ventures come with wild volatility — the kind that can deliver spectacular gains or equally devastating losses. With options, however, traders can enjoy the best of both worlds: leverage that offers high payout potential, paired with the steadier price behavior of a company like Colgate.

The main challenge with trading CL stock — and similar names — lies in their underlying efficiency. Colgate’s price movements are orderly precisely because its valuation is well understood, leaving few mispricings to exploit. Large directional moves are rare, meaning the biggest potential trades are also the riskiest.

In markets this efficient, traditional fundamental and technical analysis often reach their limits. Both approaches depend heavily on the analyst’s individual perspective — if an opportunity isn’t perceived, it may be overlooked entirely. A more robust and objective alternative is quantitative analysis, which allows traders to identify patterns and inefficiencies that human judgment alone might miss.

A Novel Approach That Will Almost Surely Change Options Trading

As you might guess, quantitative analysis is the study of pricing behavior to establish forward probabilities, with the end goal of extracting potentially profitable trading ideas. While this sounds like technical analysis, the core difference is falsifiability. In the quant approach, the premise is functionally non-contingent; other quants can see the same signal and calculate the exact same outcomes.

Now, we’re not going to get into the math, which heavily relies on the work of Andrey Markov and Russian axiomatic probability theory. From a practical perspective, though, the quant approach is fundamentally based on GARCH (Generalized Autoregressive Conditional Heteroskedasticity) models, which model volatility as a diffusive, dependent, clustered phenomenon rather than a linear, orderly mechanism.

In simple terms, volatility today depends heavily on the magnitude of volatility yesterday. Also, immediate catalysts have an exponentially greater impact on current market behavior than catalysts that occurred some time in the past.

Getting Down to Brass Tacks for CL Stock

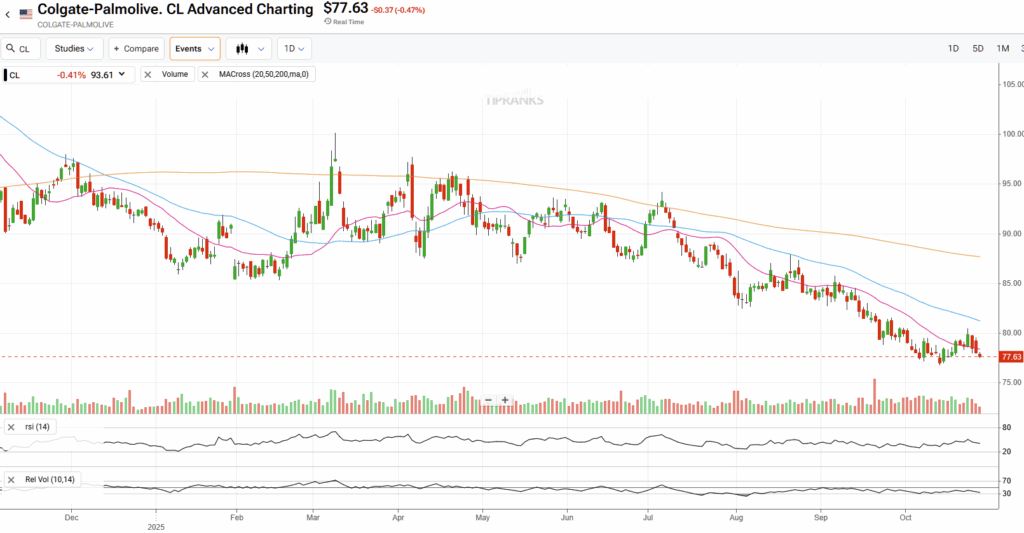

Based on historical pricing data, a quant signal has occurred. In the past 10 weeks, CL stock has printed a 3-7-D sequence: three up weeks, seven down weeks, with an overall downward trajectory. We’re not really concerned with the signal per se. Instead, the critical point is that CL is no longer in a homeostatic state but is under a specific stimulus.

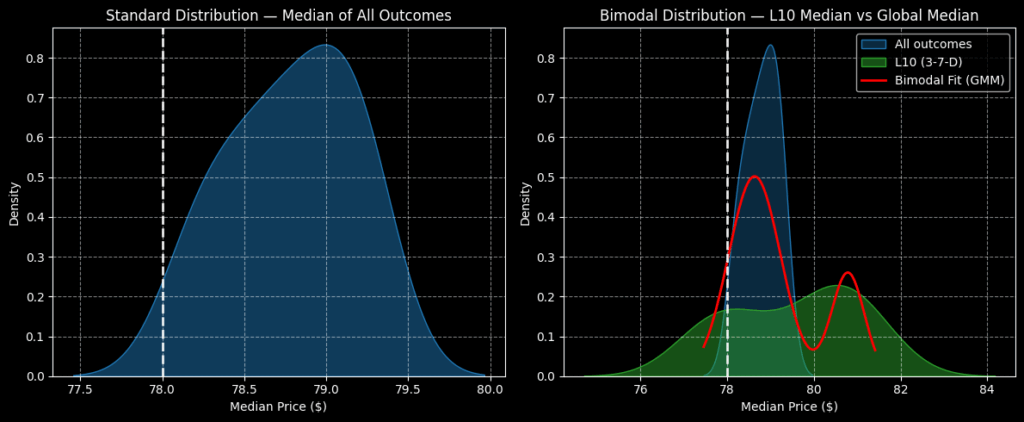

Under baseline conditions, Colgate stock’s projected 10-week returns would be expected to form a slightly skewed standard distribution, with median price outcomes mostly ranging between $77.50 and $80 (assuming a starting point or anchor price of $78, Friday’s close). Further, price clustering would be expected to occur around $79.

However, under 3-7-D conditions, the probabilistic distribution curve flattens, with the risk tail extending out to around $75 and the reward tail rising to roughly $84. More significantly, price clustering would be expected around $81. That’s a 2.53% positive delta in price clustering dynamics that other methodologies are completely blind to.

What’s more, the exceedance ratio between the sixth and tenth forward weeks is projected to reach 78.3% or higher. Therefore, while the risk tail has admittedly expanded, the data tell us that under 3-7-D conditions, the bulls have the statistical edge.

Of course, we’re dealing with probabilities, not certainties. Therefore, extreme care is required. Nevertheless, the empirical history points to investors buying the dip. We can use this knowledge in advance to craft a trading strategy.

In particular, I’m looking at the 77.50/82.50 bull call spread expiring December 19. This transaction involves buying the $77.50 call and simultaneously selling the $82.50 call, for a net debit paid of $255 (the maximum possible loss on the trade).

Should CL stock rise through the second-leg strike ($82.50) at expiration, the maximum profit is $245, a payout of over 96%. While this strike is a bit ambitious, the breakeven price for the trade above is $80.05, which is well within reason.

Is Colgate-Palmolive a Good Stock to Buy?

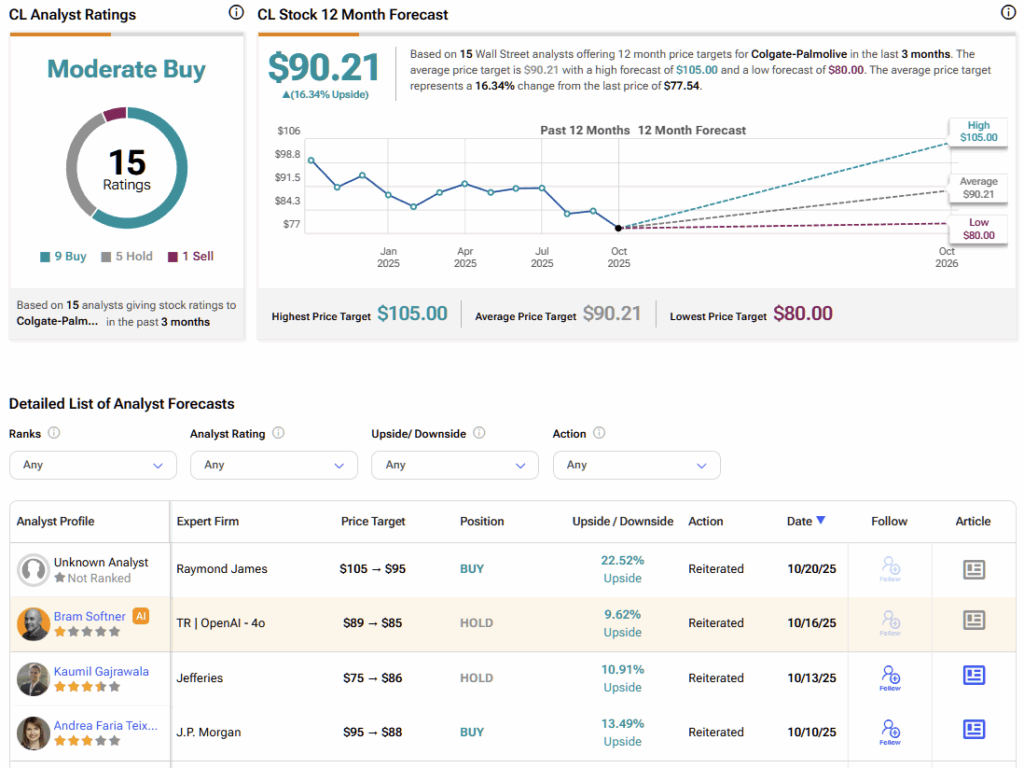

Turning to Wall Street, CL stock carries a Moderate Buy consensus rating based on nine Buys, five Holds, and one Sell rating obtained over the past three months. The average CL price target is $90.21, implying 16% upside potential over the coming 12 months.

Why Quant Thinking Wins in the Options Market

Ultimately, because options trading operates within clearly defined profit parameters and time constraints, the methodology must be precise. Traditional fundamental and technical analysis offer limited value in this context — the market is indifferent to opinions or sentiment. With options, an outcome is binary: the trade will either be profitable or it won’t.

Given this reality, a quantitative approach is essential for estimating forward probabilities with objectivity. At present, the data on CL stock appears highly compelling — though, as always, it’s up to each trader to decide whether to act on it.