Colgate-Palmolive (NYSE:CL) shares are ticking higher today after the consumer products major delivered a better-than-anticipated performance for the fourth quarter, with EPS of $0.87 outpacing estimates by $0.02. Further, revenue of $4.95 billion fared better than expectations by $60 million, growing by 6.9% year-over-year.

For the full year, organic sales increased by 8.5%. Further, a focus on productivity and efficiency helped drive margin gains and higher free cash flow. Notably, Colgate now commands a 41.1% market share in toothpaste and a 31.5% market share in manual toothbrushes globally. The company continues to invest in brand building and expects elevated levels of brand investment this year.

During the quarter, net sales rose by 3.5% in North America and by 18% in Latin America on the back of volume and pricing gains. Further, favorable pricing offset lower volumes in the Europe and Asia Pacific regions. Looking ahead to Fiscal year 2024, Colgate expects net sales growth to be in the range of 1% to 4%. Organic sales growth for the year is anticipated to be in the range of 3% to 5%. Further, it anticipates an uptick in gross margins and a mid-to-high-single-digit percentage growth in EPS for the year.

Is CL Stock a Good Investment?

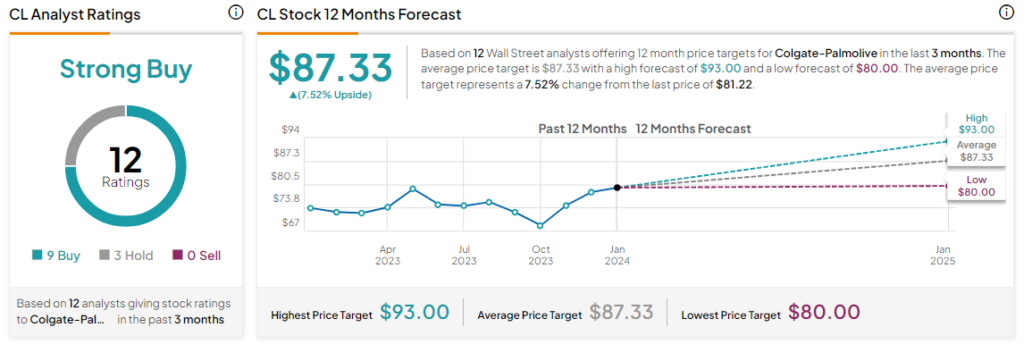

Overall, the Street has a Strong Buy consensus rating on Colgate-Palmolive. Following a nearly 7.2% rise in the company’s share price over the past year, the average CL price target of $87.33 points to a further 7.5% potential upside in the stock.

Read full Disclosure