Commercial-stage biopharmaceutical company Coherus BioSciences (NASDAQ: CHRS) surged in pre-market trading after announcing that it will divest its ophthalmology franchise Cimerli (ranibizumab-eqrn) to Sandoz (SDZNY) for an upfront, all-cash consideration of $170 million. This will also include an “additional amount for CIMERLI product inventory and subject to customary working capital adjustments at the closing date.”

As a part of this divestiture, the company is divesting its CIMERLI biologics license application, sales teams, product inventory, and commercial software. The company expects that this move will enable it to pay down debt, cut interest costs, and shift focus to its core therapeutic area of oncology. The divestiture is also likely to lead to a reduction in headcount and overhead costs, strengthening the oncology business.

Coherus anticipates this divestiture to close in the first half of 2024.

Is CHRS Stock a Buy?

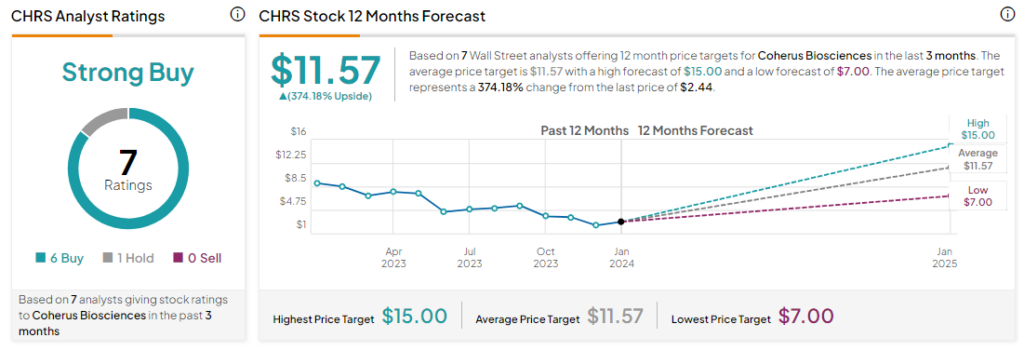

Analysts remain bullish about CHRS stock with a Strong Buy consensus rating based on six Buys and one Hold. Over the past year, CHRS stock has declined by more than 70%, and the average CHRS price target of $11.57 implies an upside potential of more than 374% at current levels.