The cocoa crisis, marked by a tripling of cocoa prices in the past year due to challenges faced by cocoa growers in West Africa, sets cocoa on track for a third consecutive year of limited supply. The rocketing price has chocolate manufacturers trying to pass the higher ingredient cost on to consumers. However, this is beginning to meet resistance as some families are instead finding alternatives to chocolate. Shoppers have become more likely to substitute other treats to fill their dessert menu, shopping carts, and Easter baskets.

Why Cocoa Prices Are Surging

Cocoa prices have tripled compared to a year ago, with the trend continuing to rise due to challenges faced by cocoa growers in West Africa, setting cocoa on track for a third consecutive year of limited supply.

Compounding this issue, the European Union (EU) plans to introduce regulations focused on thwarting the sale of some products believed to harm forests. Cocoa bean harvesting is expected to be included in the category.

Additionally, as cocoa supply tightens, investors question whether regions like Brazil and Ecuador, significant players in the chocolate industry, can successfully stem the price surge in the near future. Despite the diligent efforts of these South American countries to boost production, the time lag associated with the maturation of newly planted cocoa trees poses a considerable challenge.

Unfortunately, there seems to be no immediate relief from the escalating price pressures. The International Cocoa Organization forecasts a notable decline in the stockpile-to-grinding ratio, highlighting a tightening supply and excess capacity, reaching its lowest level in 40 years.

Consumer Reaction to Higher Chocolate Prices

While we all relish indulging in our favorite chocolate bar, unlike essential goods, chocolate reaches a price threshold where consumers say, “Enough is enough!” This response ties back to the economic principle known as the “elasticity of demand.” Essentially, this concept highlights that as prices continue to escalate, consumers ultimately seek alternatives or opt to go without the product.

It’s important to note that during traditional chocolate-centric occasions like Easter and Mother’s Day, some individuals may continue to treat themselves. However, as prices rise throughout the year, consumers are increasingly inclined to swap their Hershey (NYSE:HSY) bar for more affordable alternatives. This shift in consumer behavior has the potential to impact chocolate companies, leading to diminishing sales and reduced profits.

In response to this changing landscape, companies such as Hershey are proactively adapting their product offerings to retain customers as they navigate these shifts in consumer preferences. While Hershey remains a household name synonymous with chocolate in the U.S., the company now introduces larger Kit-Kat lemon crisp bars and assortments with a higher proportion of gummy bears to chocolate bars. The strategic reduction of chocolate bars in assortment bags, known as shrinkflation or product downsizing, reflects the company’s innovative approach to evolving market conditions.

Impact of Rising Cocoa Prices on Chocolate Makers

In the current landscape of the chocolate industry, where cocoa prices have surged to three times their previous levels, chocolate manufacturers are facing a significant hurdle.

Not only do they need to grapple with absorbing the inflated cocoa prices, but they also need to carefully consider how to pass on these costs to consumers without risking a decline in customer loyalty.

According to recent Nielsen data, the price per unit of chocolate in the U.S. has risen by 10.4% this year, indicating a slower growth rate compared to the 14.3% increase observed in the corresponding period last year. This slight deceleration in price growth may reflect the delicate balance that chocolate makers are trying to strike between maintaining profitability and retaining their customer base.

To weather the impact of soaring cocoa prices, one strategic approach for these businesses could involve diversifying their product offerings beyond traditional chocolates. By exploring alternative confectionery items or even venturing into the realm of healthier food products, chocolate makers may increase their resilience and adaptability in the face of market fluctuations.

Through this strategic shift towards greater diversification, chocolate manufacturers can potentially mitigate the adverse effects of the escalating cocoa prices and safeguard their long-term sustainability in the competitive confectionery market.

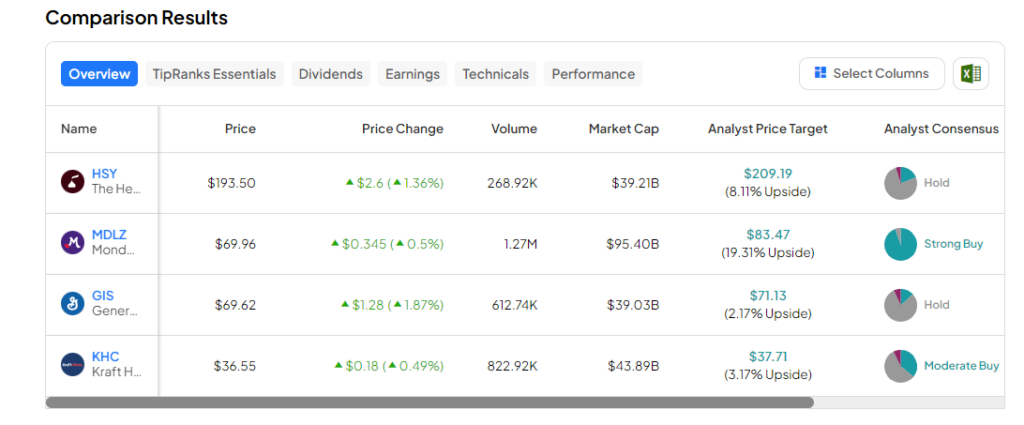

TipRanks’ comparison chart gives a glimpse into the stocks of major chocolate manufacturers trading on the U.S. stock exchange:

Key Takeaway

In summary, rising cocoa prices are posing challenges for chocolate makers as they try to manage costs while keeping customers loyal. Consumers are exploring other options due to higher chocolate prices, impacting market dynamics. Investors should monitor how companies like Hershey adjust to changing consumer preferences, as well as watch how chocolate-producing regions like Brazil and Ecuador counter supply chain constraints. Moreover, TipRanks Premium aids investors in staying well-informed, making strategic decisions, and navigating the dynamic market to identify promising stocks with growth potential in the confectionery sector.