Coca-Cola (NYSE:KO) posted its fourth-quarter results in February, which were marked by strong organic revenue and earnings growth. The beverage industry titan also celebrated its 62nd consecutive dividend increase, this time by 5.4%—its biggest hike since 2018. With further earnings growth expected in FY2024 and dividend increases likely to keep beating inflation, Coca-Cola continues to offer a compelling case for conservative dividend investors. Consequently, I’m bullish on KO stock.

Q4: Strong Results Despite Tough Pricing Environment and Growing Competition

Coca-Cola’s Q4-2023 results came in strong, in my view, with the company posting robust organic growth despite a tough pricing environment and growing competition. Let’s take a deeper look.

For the quarter, net revenues rose by 7% to $10.8 billion, while organic revenues (a non-GAAP metric) saw an even more significant increase at 12%. Coca-Cola’s organic growth can be broken down to a 9% growth in price mix and a 3% uptick in concentrate sales (i.e., sales of the company’s special mix that third parties use to make drinks). That 3% included a one-percentage-point boost due to the quarter having an extra day.

Looking deeper at Coca-Cola’s organic growth, which is the most meaningful figure, as it excludes special events, such as brand divestitures, the 12% increase aligned with management’s full-year organic revenue growth outlook.

Notably, unit case growth came in positive, at 2%, and it’s worth mentioning that unit case growth was positive in each quarter of 2023. However, the main driver behind the double-digit organic growth was a price mix growth of 9% in Q4, which was, in turn, powered by three factors:

- Standard, industry-like price increases during the year across most of its markets,

- Hyperinflationary pricing in three unnamed markets in which Coca-Cola operates, likely including Argentina,

- Variations in product mix — mostly timing related.

In my view, what stands out here is Coca-Cola’s remarkable ability to navigate a tough pricing landscape and fierce competition.

Regarding pricing, Coca-Cola maintained its position as a leader in offering some of the most affordably priced sodas and beverages in supermarkets. As a casual consumer of Coca-Cola Zero myself, I observed the gradual price increases at my local stores over the past year, which pretty much mirror the high-single-digit price hikes the company discussed in Q4.

Yet, despite these adjustments, Coca-Cola’s beverages are still the most affordable. This is crucial, in my view, because it gives Coca-Cola a much-needed advantage in a highly competitive market. Competing brands tend to command higher prices, as they lack Coca-Cola’s scale and distribution network. Thus, it’s easy to see why consumers who seek affordable beverages gravitate towards Coca-Cola drinks by default.

This is evident by Coca-Cola posting positive unit case growth in each quarter of FY2023 despite the soft drinks market becoming increasingly crowded by the day. I mean, the soft drinks market has always been fiercely contested, but the current landscape is particularly intense, with numerous influencers endorsing various brands.

A nice example of one of Coca-Cola’s most prominent yet still up-and-coming competitors is Celsius Holdings (NASDAQ:CELH), whose “functional” highly caffeinated beverages are rapidly gaining traction in the market. Notably, its sales surged by 102% in FY2023 to $1.32 billion, following its huge growth rates of 108% and 140% in FY2022 and FY2021, respectively. In this context, seeing Coca-Cola’s unit case go up consistently is truly praiseworthy.

Higher Volumes, Cost Efficiencies Drive EPS Growth

Coca-Cola’s margin benefited in Q4, driven by higher volumes and cost efficiencies, which, in turn, drove notable earnings growth. Specifically, its comparable gross margin for the quarter rose by about 140 basis points, while its comparable operating margin expanded by about 40 basis points to 23.1%. Accordingly, adjusted earnings growth per share jumped 10% to $0.49. For the year, adjusted earnings per share rose by 8% to $2.69.

Dividend Increases to Keep Beating Inflation

With Coca-Cola posting strong earnings per share growth last year, this February’s dividend increase was by 5.4%—its biggest hike since 2018. For context, here are Coca-Cola’s dividend increases over the past eight years:

- 2017 Dividend Increase: 5.7%

- 2018 Dividend Increase: 5.4%

- 2019 Dividend Increase: 2.6%

- 2020 Dividend Increase: 2.5%

- 2021 Dividend Increase: 2.4%

- 2022 Dividend Increase: 4.8%

- 2023 Dividend Increase: 4.5%

- 2024 Dividend Increase: 5.4%

The recent reacceleration in dividend growth signals management’s confidence in Coca-Cola’s ability to achieve mid-single-digit earnings growth in the medium term, in my view. Also, consensus estimates for FY2024 point toward adjusted EPS of $2.81 for the year, implying a forward payout ratio of about 69%.

Given that Coca-Cola’s adjusted earnings payout ratio has averaged close to 77% over the past decade, I believe that this is another indicator that the Board will feel comfortable with pursuing inflation-beating dividend hikes in the coming years.

This, combined with Coca-Cola’s legendary 62-year-long dividend growth track record and decent yield of 3.2%, continues to make the stock a strong candidate for conservative investors who seek stable income growth and minimal volatility.

Is KO Stock a Buy, According to Analysts?

Looking at Wall Street’s view on the stock, The Coca-Cola Company bears a Moderate Buy consensus rating based on 11 Buys and four Holds assigned in the past three months. At $66.20, the average KO stock price target suggests 10.55% upside potential.

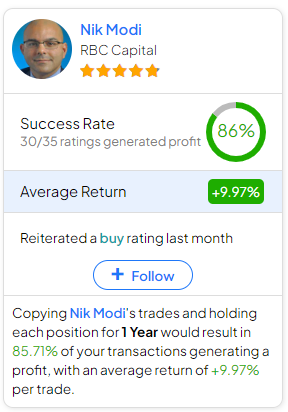

If you’re wondering which analyst you should follow if you want to buy and sell KO stock, the most accurate analyst covering the stock (on a one-year timeframe) is Nik Modi of RBC Capital, with an average return of 9.97% per rating and an 86% success rate. Click on the image below to learn more.

The Takeaway

To sum up, I believe that Coca-Cola’s fourth-quarter results highlight its resilience and competitive edge in the beverage market. Despite challenges such as a challenging pricing environment and intensifying competition, Coca-Cola once again demonstrated robust organic and earnings growth.

In the meantime, the recent 5.4% hike suggests that management feels confident in the company’s ability to sustain solid earnings growth in the coming years. With the likelihood of dividend increases likely to keep beating inflation in the coming years, its already legendary dividend growth track is recording inspiring dependability. Therefore, Coca-Cola remains a prime pick for conservative, income-oriented investors.