Coca-Cola Bottling Co Consolidated (COKE) has announced an expansion in Columbus, Ohio via a $90 million investment. This will have it opening a new 400,000-square-foot distribution and warehouse campus capable of handling 16 million cases of soda annually.

Confident Investing Starts Here:

- Quickly and easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks straight to you inbox with TipRanks' Smart Value Newsletter

The grand opening for the distribution and warehouse facility is set for today, with Ohio Governor Mike DeWine and Coca-Cola (KO) officials attending. The location will make use of Coca-Cola Bottling’s Vertique system, improving productivity, efficiency, accuracy, and working conditions. This will allow the company to better serve the Columbus area, while creating jobs to boost the local economy.

What Does This Mean for Coca-Cola?

The expansion by Coca-Cola Bottling is good news for Coca-Cola. It increases the distribution of the beverage company’s products, allowing it to more easily reach a wider group of consumers.

Additionally, Coca-Cola benefits when Coca-Cola Bottling does well. While Coca-Cola Bottling is an independent bottler, Coca-Cola is invested in the company. Coca-Cola holds 1,883,546 shares of COKE stock, representing a 24.42% stake in the bottling company that’s worth approximately $2.64 billion.

In related news, COKE stock could undergo a stock split soon. Investors are set to vote on a 10-for-1 split during the company’s annual shareholder meeting today. If approved, this would grant investors nine additional shares and reduce the stock’s trading price on Friday, without affecting its market cap. This move could help it attract new investors with a lower entry point.

KO vs. COKE Stock

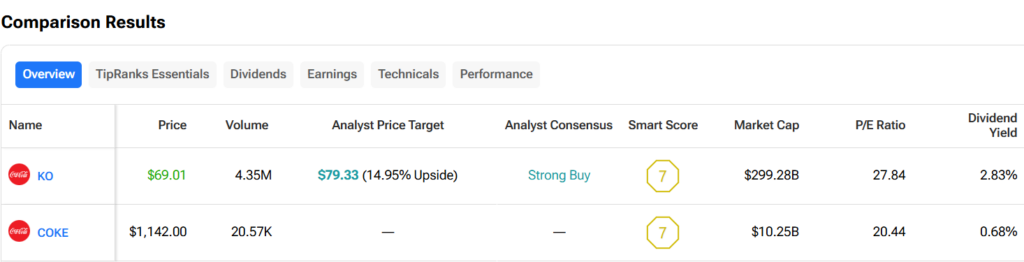

Turning to the TipRanks comparison tool, traders can get all the insight needed when considering investments. KO stock has a consensus Strong Buy rating and price target of $79.33, representing a potential 14.95% upside, while COKE stock lacks significant investor coverage. TipRanks’ AI Analyst offers a 66 Neutral score for COKE shares. This points to KO as the better investment over COKE.