Shares of Cleveland-Cliffs (NYSE:CLF) slipped in after-hours trading after the company reported earnings for its fourth quarter of Fiscal Year 2023. Earnings per share came in at -$0.05, which was in line with analysts’ consensus estimate. Sales increased by 1.4% year-over-year, with revenue hitting $5.11 billion. This missed analysts’ expectations by $40 million.

For the full year, the company reported steel shipments totaling 16.4 million net tons, notably setting a record in the automotive sector. The firm posted an adjusted EBITDA of $1.9 billion, coupled with a robust cash flow of $2.3 billion and free cash flow of $1.6 billion. In addition, it reduced its net debt to $2.9 billion.

Looking forward, management is forecasting a $30 per net ton reduction in steel unit costs for 2024. Additionally, Cliffs expects its capital expenditures to be between $675 and $725 million.

Is CLF Stock a Buy or Sell?

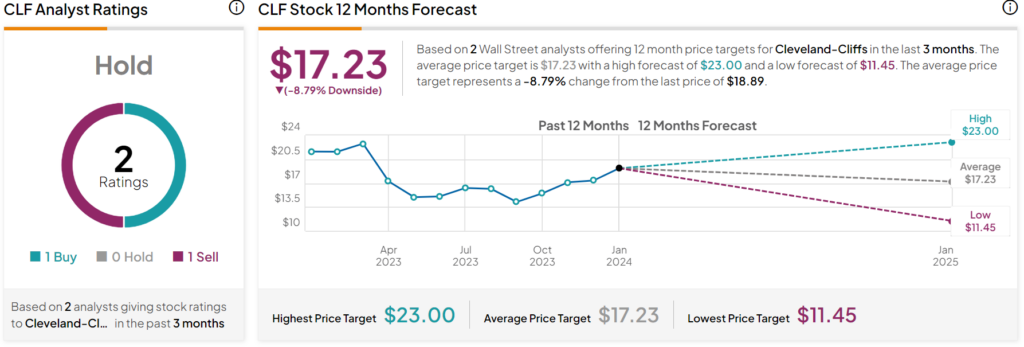

Turning to Wall Street, analysts have a Hold consensus rating on CLF stock based on one Buy, zero Holds, and one Sell assigned in the past three months, as indicated by the graphic below. After a 7% rally in its share price over the past six months, the average CLF price target of $17.23 per share implies 8.79% downside risk.