A class action lawsuit was filed against B. Riley Financial (NASDAQ:RILY) on January 24, 2024. The plaintiffs (shareholders) alleged that they bought B. Riley Financial stock at artificially inflated prices between May 10, 2023 and November 9, 2023 (Class Period) and are now seeking compensation for their financial losses. Investors who bought RILY stock during that period can learn about joining the lawsuit here: https://zlk.com/pslra-1/b-riley-lawsuit-submission-form?wire=16.

California-based B. Riley Financial is a financial services company. It offers diverse services, including investment banking, asset management, advisory services, real estate solutions, wealth management, and venture capital.

The plaintiffs maintain that the company and three of its senior officers deceived investors by repeatedly lying and withholding vital information about the company’s business practices and prospects during the Class Period. Importantly, the lawsuit maintains that the defendants omitted truthful information about the bank’s involvement with its client Brian Kahn, CEO of Franchise Group, Inc. (FRG).

The information became clear in a series of events between November 2, 2023 and November 9, 2023, when Kahn was initially convicted as a co-conspirator in a conspiracy to defraud investors (Prophecy Asset Management) of $294 million in funds. Interestingly, reports accused B. Riley of having knowledge of Kahn’s involvement.

Finally, on November 9, 2023, after the market closed, B. Riley revealed important details regarding the FRG transaction, and the multiple transactions between B. Riley, Kahn, and the company’s subsidiaries that were impeached in the conspiracy.

Notably, during the Class Period, B. Riley mentioned that it agreed to provide equity financing of up to $560 million for a management buyout of FRG, led by Kahn. The company specifically noted that the bank was not a party to the merger agreement.

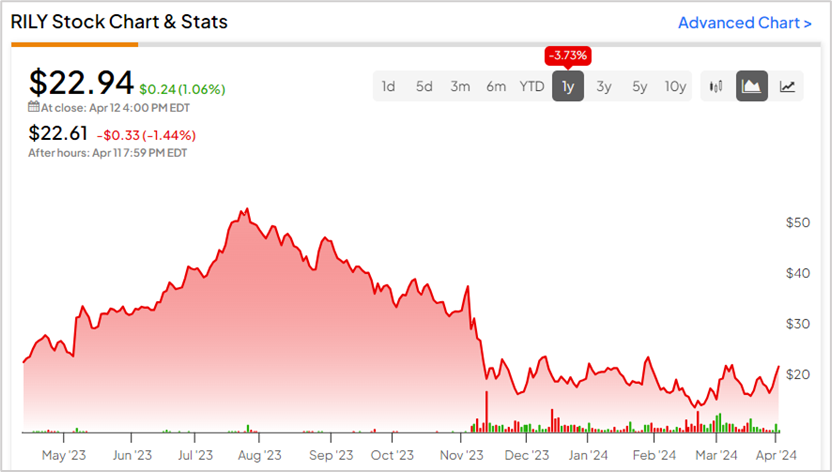

As per the class action lawsuit, B. Riley Financial caused RILY stock to trade at artificially inflated prices by knowingly and recklessly omitting truthful information about its business performance.

Notably, between November 2 and November 10, RILY stock plunged 27.7%, causing massive damage to shareholders’ returns.