Citigroup (NYSE:C) CEO Jane Fraser sent a tough message to the bank’s employees at a town hall meeting last week, asking them to “get on board” with the company’s massive overhaul plans or leave the organization, the Financial Times reported. Fraser is slashing jobs and streamlining the top management structure. However, the CEO has not yet revealed the exact number of layoffs or a cost reduction target, resulting in frustration among employees.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Citi Focused on Major Reorganization

During last week’s meeting, Fraser said that the management has “incredibly high ambitions” for the bank, so employees should “lean in, help us win with clients, help us deliver the changes, or get off the train.”

The third-largest U.S. bank announced a significant corporate reorganization plan on September 13. Under the plan, the bank is being reorganized into five main business lines that would directly report to the CEO. With the elimination of certain management layers, Citi expects the flatter structure to speed up decision making and drive better accountability.

Some of the senior executive departures noted since the company’s restructuring announcement include Eduardo Cruz, the head of Citi’s Latin American investment banking operations and Kristine Braden, the European unit head. Last week, the bank’s U.K. employees were sent a memo conveying that the bank would begin a review process that would lead to job reductions. However, the memo didn’t specify the number of jobs that would be eliminated.

While some employees are excited about the CEO’s efforts to revamp the bank and improve profitability, others are worried due to the uncertainty associated with the extent of job cuts.

It is important to note that one of the major aspects of Fraser’s overhaul plans is to reorganize the bank around its units rather than its geography. Fraser is eliminating most of its geographic management roles to simply the organization and cut costs. Citi has appointed Ernesto Torres Cantú as the head of its international business, doing away with the old model that involved three regional chiefs.

What is the Forecast for C stock?

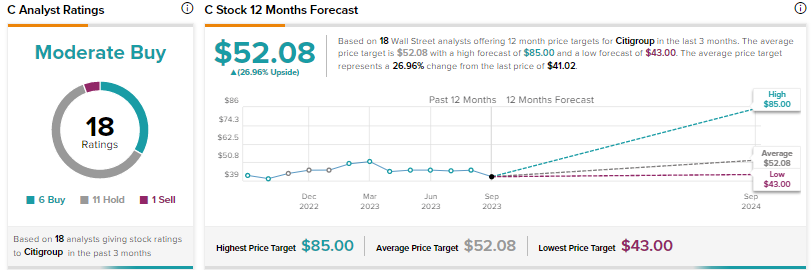

Wall Street’s Moderate Buy consensus rating on Citigroup stock is based on six Buys, 11 Holds, and one Sell. The average price target of $52.08 implies 27% upside potential. Shares have declined 9.3% year-to-date.