Citi (C) sees the market splitting. Ethereum gets a bump while Bitcoin gives back a little. The bank’s year-end target sits at $4,500 for Ethereum and $133,000 for Bitcoin. This implies ~3% upside for Ethereum and ~12% for Bitcoin from current levels.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The 12-month view stretches higher. Citi models Ethereum at $5,440 and Bitcoin at $181,000 over the next year, assuming flows stay healthy and liquidity conditions do not deteriorate.

Ethereum Attracts Yield Seekers

The case for Ethereum is flow driven. Citi points to a summer pickup from institutions and advisors and a steady shift toward assets that can generate yield. Staking and DeFi are doing the heavy lifting here.

ETFs and corporate treasuries add a second tailwind. More regulated wrappers and balance-sheet allocations widen access and keep demand consistent rather than episodic.

Bitcoin Faces Macro Crosscurrents

Bitcoin still owns the digital-gold lane, but macro is in the way. Citi cites a firmer dollar and softer gold as reasons to trim near-term expectations. That does not break the store-of-value story, it just slows it.

Flows remain the swing factor. Citi’s base case assumes roughly $7.5B of year-end inflows. A stronger equity tape and improving risk appetite lift the bull case. A recessionary setup pulls it the other way.

Scenarios Frame the Range

On the downside, Citi maps a Bitcoin bear case near $83,000 if growth rolls over and liquidity tightens. Ethereum’s downside is harder to pin down since network activity and value accrual can move out of sync with price.

On the upside, Ethereum benefits from adoption plus yield while Bitcoin benefits from broadening participation in the digital-gold narrative. Both are currently trading above user-activity metrics, which makes sustained demand the key.

Demand Decides the Finish

This market is still about liquidity and access. Ethereum is winning incremental flows thanks to yield and product design. Bitcoin keeps its role as the macro hedge that institutions understand.

If inflows stay steady into Q4, Citi’s path of modest Ethereum outperformance and constructive Bitcoin holds. If flows fade, both targets get harder to reach.

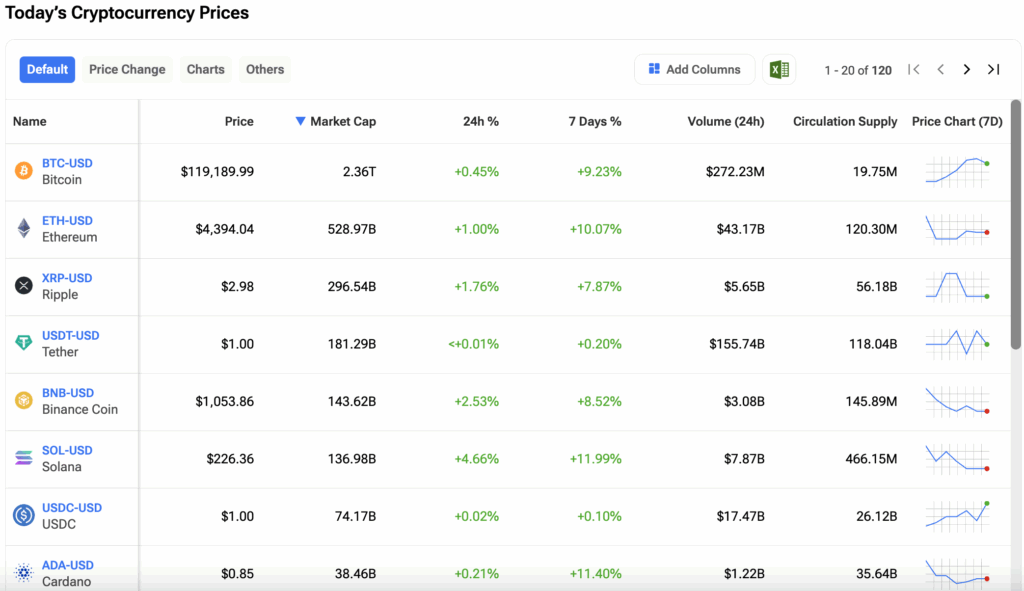

Investors should stay informed by tracking the prices of their favorite cryptos on the TipRanks Cryptocurrency Center.