For health insurance company Cigna (NYSE:CI), plans of a potential merger with Humana (NYSE:HUM) were nothing short of a disaster in the making. In fact, investors ran for the hills, taking close to 8% of Cigna’s entire market cap with them in Wednesday afternoon’s trading.

Reports emerged that Cigna and Humana were in talks about getting together, though neither company when approached, would comment about the plan, if it even existed. But the idea that it might exist was enough to send investors into a frenzy of evacuation. Reports note the deal—if it comes about—would be a combined stock-and-cash deal.

Cigna’s market value currently sits around $80 billion, and Humana’s stands at around $63 billion. Thus, any deal made in that direction would be a monster deal by any standard. The whole thing started when Cigna dropped word that it was looking to sell off its Medicare Advantage operations. Cigna wouldn’t talk about it, considering the matter “rumors or speculation.” But Cigna’s plan to ditch Medicare Advantage could have been a lead-in toward getting together with Humana.

Not the Only Sign of Change

The idea that something’s happening within Cigna isn’t out of line. There have already been some signs of change afoot. A report from the Arkansas Democrat-Gazette revealed that patients in the Baptist Health system will be “out of network” starting in January. What’s more, even if the merger deal ultimately goes through, it’s a safe bet that it will be promptly challenged by the Federal Trade Commission (FTC), which has pursued virtually every large-scale deal in the last two years or so.

Is Cigna a Good Stock to Buy Now?

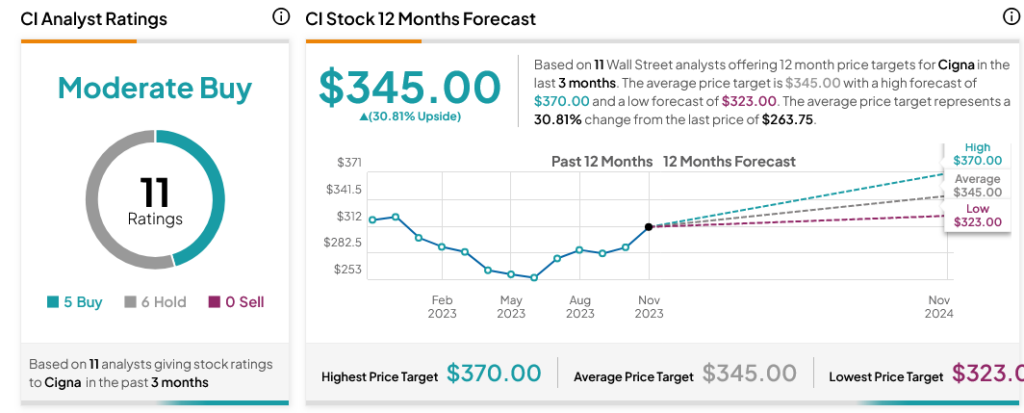

Turning to Wall Street, analysts have a Moderate Buy consensus rating on CI stock based on five Buys and six Holds assigned in the past three months, as indicated by the graphic below. After a 17.41% loss in its share price over the past year, the average CI price target of $345 per share implies 30.81% upside potential.