Property and casualty insurance provider Chubb Limited’s (NYSE:CB) board has approved a share buyback program of up to $5 billion, effective July 1, 2023. The strategic decision undertaken by Chubb is not only focused on increasing shareholders’ value but has also garnered the attention of Wall Street analysts, who recognize strong growth potential in CB stock.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

CB also said that the new buyback authorization comes with no expiration date. Also, the company’s existing share repurchase plan will remain effective until the end of June.

Last month, the company announced a 4% hike in its quarterly dividend to $0.86 per share. Based on its recent closing price of $190.55, CB offers a forward dividend yield of 1.8%.

Interestingly, Chubb is a dividend aristocrat and has been raising dividend amounts for about 30 consecutive years. Furthermore, the company’s consistently growing earnings and a low payout ratio of 21% make these distributions sustainable.

CB’s Recent Financial Performance

Chubb continues to generate decent cash each quarter. The company reported a 14% sequential jump in cash to $2.3 billion in the first quarter of 2023.

Furthermore, the company’s Q1 performance was encouraging, as it witnessed 15.6% year-over-year growth in net premiums in the reported quarter. The strong performance of Commercial and Consumer P&C businesses along with the International Life business aided the results.

It is worth highlighting that CB is benefitting from the acquisition of Cigna’s Life Insurance Business in Asia-Pacific, which was completed in July 2022. Furthermore, Chubb is strategically expanding its footprint in Asia by augmenting its ownership stake in Huatai, a prominent securities firm based in China.

Is Chubb a Good Stock to Buy?

Chubb stock has a Moderate Buy consensus rating on TipRanks. This is based on nine Buy, two Hold, and one Sell recommendations. Meanwhile, Wall Street analysts are bullish about the company’s price trajectory. The average price target of $237.25 implies 24.5% upside potential from current levels. CB stock is down 13.3% in 2023 so far.

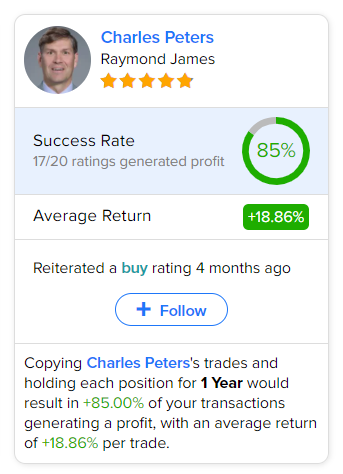

Investors looking for the most accurate and profitable analyst for CB could follow Raymond James analyst Charles Peters. Copying the analyst’s trades on this stock and holding each position for one year could result in 85% of your transactions generating a profit, with an average return of 18.86% per trade.