Penny stock (learn more about penny stocks here) ChargePoint Holdings (NYSE:CHPT) fell about 7.5% in Tuesday’s after-hours trading. The company, which provides Electric Vehicle (EV) charging solutions, delivered lower-than-expected revenue in Q4 2023.

Further, ChargePoint expects continued weakness in its top line and offered a weaker-than-expected Q1 revenue outlook.

A Brief Look at ChargePoint’s Q4 Performance

ChargePoint delivered fourth-quarter revenue of $115.8 million, down 24% year-over-year. Further, its top line fell short of analysts’ estimate of $120 million. The company’s Networked Charging Systems revenue dropped 39% year-over-year, as challenging macroeconomic conditions continued to weigh on volumes. Nonetheless, the company’s high-margin Subscription revenue jumped 30% year-over-year.

ChargePoint’s net loss of $0.23 per share in Q4 remained flat year-over-year and was in line with the Street’s forecast.

ChargePoint Expects Continued Decline in Sales

ChargePoint forecasts revenue of $100 million to $110 million in the first quarter of Fiscal 2025. At the midpoint, the guidance reflects a 19% year-over-year decrease.

Nonetheless, the company’s management reaffirmed that it would achieve a positive adjusted EBITDA in the fourth quarter of FY25.

Is ChargePoint a Buy, Sell, or Hold?

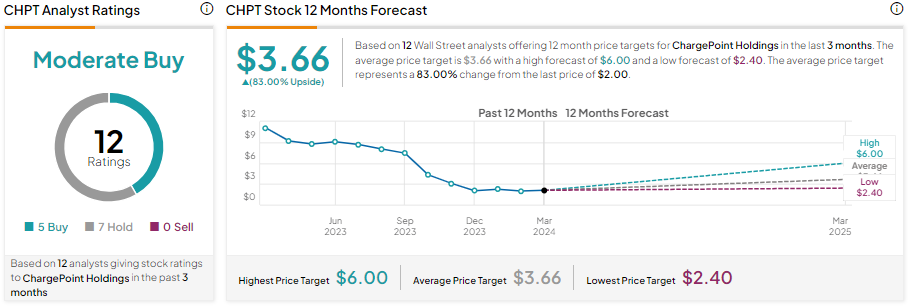

ChargePoint stock has dropped over 81% in one year. However, the company’s efforts to lower costs and achieve positive adjusted EBITDA keep Wall Street analysts cautiously optimistic. However,

Meanwhile, Goldman Sachs analyst Mark Delaney, who maintained a Hold rating on CHPT stock following the Q4 print, sees competition and slower EV industry growth as near-term headwinds.

Overall, ChargePoint stock has five Buy and seven Hold recommendations for a Moderate Buy consensus rating. Analysts’ average price target of $3.66 implies 83% upside potential from current levels.

While CHPT stock carries a Moderate Buy consensus rating, investors can leverage TipRanks’ penny stock screener to find top-rated penny stocks.