Jim Cramer’s ‘Own It, Not Trade It’ mantra, initially coined for Apple (NASDAQ:AAPL), finds resonance in various quality stocks, and Chipotle (NYSE:CMG) is one of them, in my view. Despite concerns about Chipotle’s valuation, I believe that investors should own Chipotle for the long term and stop focusing too much on short-term price movements. With CMG posting robust results, experiencing a margin expansion course, and management likely to replicate its proven strategy moving forward, I remain bullish on CMG.

Q4-2023 Results Keep Wall Street Buzzing

Chipotle’s Q4-2023 results kept Wall Street buzzing, evident in the stock sustaining its prolonged rally. I get it; you may be skeptical about the seemingly endless surge of Chipotle’s share price. However, a closer look reveals the compelling narrative: the company is on the brink of a mega-cycle marked by expanding margins, promising a sustained surge in earnings. This explains why Wall Street can’t seem to get enough of the stock. Let’s unpack the Q4 report, which clearly illustrates my point.

Growth Accelerates from Chipotle’s Simple Yet Effective Strategy

For the quarter, total revenues grew by 15.4% to $2.5 billion. From the get-go, we get a very impressive result from Chipotle, as this implies an acceleration both from the previous quarter’s growth of 11.3% and last year’s growth of 11.2%

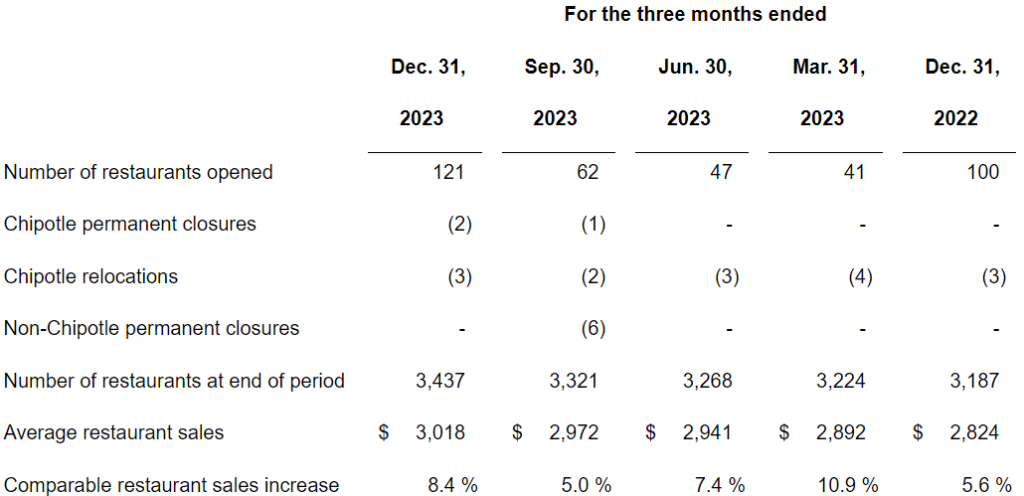

Chipotle’s growth kept gaining momentum, thanks to its clear and really powerful approach — opening new stores and boosting sales in existing ones. In Q4, sales from existing locations rose by 8.4%. Further, by the end of December, Chipotle had a total of 3,437 restaurants open, up from 3,321 last quarter and 3,187 last year.

It is noteworthy that the opening of 121 restaurants in Q4 implies a notable acceleration in Chipotle’s overall expansion rate. This figure surpasses the 62, 47, 41, and 100 restaurants opened in each of the four preceding quarters. I believe it reflects Chiptole’s ability to afford higher CapEx levels, which is evident in its free cash flow surge.

For context, Chipotle posted a record free cash flow of $1.22 billion and allocated a record $560.7 million of capital expenditures in FY2023. Both of these numbers are notably higher than the $844 million and $479 million from FY2022.

Restaurant-Level Margins Surge, Profits Are Snowballing

I previously mentioned that besides its solid revenue growth, Chipotle is on the brink of a megacycle of expanding margins, which, in turn, has resulted in its profits snowballing.

Through consistently growing its number of restaurants and growing comparable store sales, Chipotle naturally enjoys improved unit economics. To put it simply, as sales at each location rise and fixed costs, like rent, remain stable, Chipotle’s restaurant-level operating margin experiences a positive uptick.

Evidently, for Q4, Chipotle reported an average restaurant sales figure of $3.018 million, up from $2.824 million last year. Consequently, Chipotle’s restaurant-level operating margin expanded by 140 basis points to 25.4%.

Now, combine Chipotle’s solid revenue growth of 15.4%, the restaurant-level margin expansion, and the fact that the company has no debt on its balance sheet (i.e., no interest expenses to hamper net income growth), and you can see how adjusted earnings for the quarter grew by a much more significant 23.6% to $286.2 million. For the year, net income grew by an even more significant 35.1% to $1.24 billion.

Defending Chipotle’s Hefty Valuation

There is no doubt that Chipotle is a very expensive stock. The stock has surged by 73% over the past year, with its forward P/E now standing at 49.3x based on this year’s consensus EPS estimate of $53.31. Still, I believe Chipotle’s valuation can be defended.

What we can conclude by unpacking Chiptole’s Q4 results is that although Chipotle’s 15.4% revenue growth might not immediately strike as super impressive, the market is placing its confidence in the ongoing scalability and underlying margin expansion.

In fact, Chipotle is now accelerating the pace of restaurant openings. Management expects 285 to 315 new restaurant openings this year, up from 271 openings last year. With the company consistently implementing this strategy, there’s a high probability that earnings growth will remain at extraordinary levels, which I estimate between 20% and 30%, all factors considered.

Again, I want to stress that this is a proven strategy that has consistently generated exceptional earnings growth rates over the years. Further, note that Chipotle’s footprint remains very limited, especially on the international front. As a result, I believe the company can keep replicating this strategy and exploiting it for years to come. Thus, I can see the market continue to be willing to pay extraordinary multiples for the stock.

Is CMG Stock a Buy, According to Analysts?

Checking Wall Street’s view on the stock, Chipotle Mexican Grill features a Moderate Buy consensus rating. This is based on 20 Buys and eight Hold ratings assigned in the past three months. At $2734.63, the average CMG stock forecast implies 2.8% downside potential.

If you’re wondering which analyst you should follow if you want to buy and sell CMG stock, the most profitable analyst covering the stock (on a one-year timeframe) is Eric Gonzalez from KeyBanc, with an average return of 35.55% per rating and an 83% success rate. Click on the image below to learn more.

The Takeaway

Summing up my update on the stock, Chipotle’s Q4 results once again proved that the company remains in the midst of a powerful expansionary phase. With revenue growth accelerating to 15.4%, restaurant-level margins, earnings snowballing, and the pace of restaurant openings set to pick up, Chipotle stock is set to remain a Wall Street darling for years to come.

Many will tell you that Chipotle’s valuation has reached concerning levels. However, the company has consistently proven itself as a reliable long-term investment, with those betting against its stock ending up on the losing side time after time. This trend is likely to continue in the years ahead.