Founded in 1993, Chipotle Mexican Grill (NYSE:CMG) represents a benchmark staple in the fast-casual restaurant market. Think of the business model as an upscale fast-food joint. Over the years, the company has resonated with the young and upwardly mobile crowd, who desire healthier options but with the convenience of a traditional quick-service food outlet. That has enabled the company to hike prices without much consequence.

Unfortunately, there’s only so much the consumer can take. Yes, Chipotle is an amazing business. However, we’re still talking about fast food at the end of the day. While it’s distinct, it’s certainly not unique. Further, as prices continue to rise for a variety of reasons, Chipotle could become the victim of the trade-down effect; that is, people may simply eschew higher-priced offerings for cheaper alternatives.

Should consumers opt for lower-priced alternatives, then it stands to reason that the valuation of the company must be questioned. Its arguably high multiple presently reflects anticipation of robust sales. However, if a trade down materializes, it implies that Chipotle is overvalued. Therefore, I am bearish on CMG stock as it seeks a more reasonable multiple.

CMG Stock Deserves a Premium, But Not That High

Let’s be real. Take a peek at your local Chipotle store. Chances are, during peak hours, it’s significantly more crowded than competing fast food and fast-casual outlets. In financial terms, CMG stock deserves to trade at a premium valuation. Consumers obviously place a premium on going to Chipotle versus similar establishments. Still, the question is, how much should CMG’s valuation be?

Currently, CMG stock trades at 8.05x trailing-year revenue. For the restaurant sector, the average revenue multiple presently sits at 0.96x. In a strict sense, Chipotle is overvalued. There’s no other way to slice it. However, because the brand is such a dominant force in the restaurant industry, it’s unfair to simply label CMG as overpriced without context.

For the current fiscal year, analysts, on average, anticipate revenue to land at $11.27 billion. That’s up 14.1% from last year’s tally of $9.87 billion. Given the historical performance of CMG stock, it’s difficult to cast doubt on this figure. Assuming a share count of 24.42 million, Chipotle would trade at 6.22x projected 2024 sales.

Now, that’s better, but it’s still not a great deal compared to the industry. However, TipRanks reporter Amit Singh also mentioned that there’s brewing optimism for the company’s first-quarter earnings report, scheduled for release this Wednesday. Experts anticipate revenue of $2.65 billion, implying a year-over-year increase of 12.8%.

Still, even with this optimistic outlook, investors should be cognizant of Chipotle’s brand power. As stated earlier, the brand certainly resonates with customers. Unfortunately, this dominance seems vulnerable – and that’s not surprising, given the broader economic circumstances.

In Q3 2012, Chipotle’s gross profit margin hit 27.55%. Following a 2015 food safety crisis, the company’s gross margins eventually sank to a low of 12.76% before marching steadily higher. As of Q4 2023, this metric comes in at 26.2%. That’s a major accomplishment, but it also falls short of its peak.

This inability to exceed prior gross margin records – let alone match them – suggests a possible waning of brand power. In contrast, fast-food rival McDonald’s (NYSE:MCD) has seen its gross margins rise significantly from around 39% 10 years ago to 57.1% now.

Stated differently, investors shouldn’t question that CMG stock trades at a premium. Rather, they should question whether shares should trade this high, given that the brand’s dominance may have waned.

Some of Chipotle’s Woes Are Out of Its Hands

To be clear, questioning the valuation of CMG stock shouldn’t be interpreted as slamming the underlying business. We all see with our own eyes that Chipotle is a powerhouse enterprise in its industry. However, the company also suffers from significant headwinds. Some of these challenges are out of the company’s hands, which makes the situation concerning.

One of the biggest headwinds comes from California. Recently, the state implemented a $20/hour minimum wage law that specifically targets fast-food chains. Restaurants with fewer than 60 locations nationwide enjoy an exemption. Obviously, that loophole doesn’t fit Chipotle, and of course, the company’s upset.

Predictably, Chipotle and McDonald’s blamed price hikes on the minimum wage law. Essentially, these two enterprises will pass the cost of California’s legislation to their customers. From an investment standpoint, that response might work for the Golden Arches, as McDonald’s gross margin is high and has steadily risen over the years. Investors have confidence that McDonald’s can pass off those costs.

The situation is trickier for Chipotle. Yes, its gross margin has also significantly increased since the aftermath of the food crisis. However, it’s still lower than pre-crisis levels. So, it’s questionable whether Chipotle customers will accept the cost pass-down.

What’s more, CMG stock is especially vulnerable to the trade-down effect. One of McDonald’s core attributes is convenience. Whether in-store or via drive-thru, consumers get their orders very quickly. So, McDonald’s is more resilient against trade-down pressures.

On the flip side, Chipotle is not as convenient as McDonald’s. Further, there are multiple mom-and-pop restaurants exempt from California’s minimum wage laws that can effectively duplicate Chipotle’s products for less. And if consumers value attractive pricing and healthy options, then the deli inside major grocery stores may impose significant competition.

Is CMG Stock a Buy, According to Analysts?

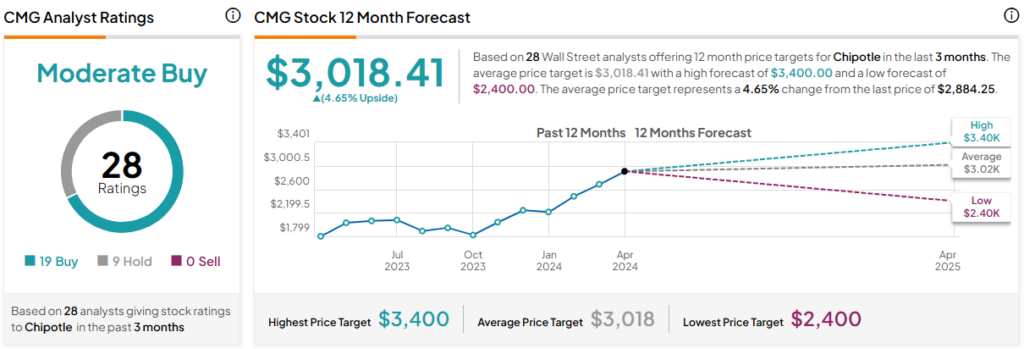

Turning to Wall Street, CMG stock has a Moderate Buy consensus rating based on 19 Buys, nine Holds, and zero Sell ratings. The average CMG stock price target is $3,018.41, implying 4.65% upside potential.

The Takeaway: CMG Stock Could Encounter a Reality Check

In closing, Chipotle is a popular brand that certainly deserves a premium valuation over the restaurant industry average. However, CMG stock may have overshot its fundamentals, particularly because its long-term gross margin trend reflects a possible weakening of brand power relative to the competition. Therefore, the company’s plan to raise prices following California’s minimum wage law may force a reality check as consumers seek cheaper options.