Remember the great chip shortage? When it seemed like everyone who could make a microchip was basically printing gold? That time may have come and gone because new reports are making things downright unpleasant for the chip market. A superfluity of red ink has landed on the sector, and major chip stocks are showing red all over.

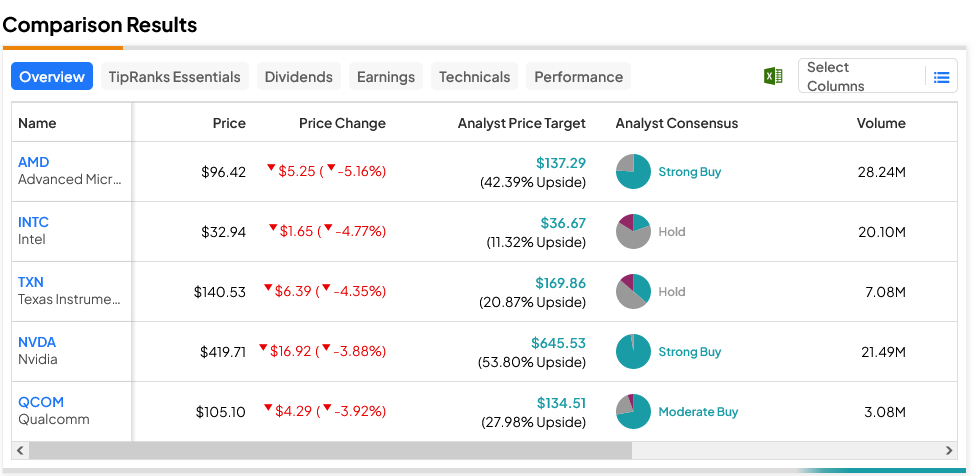

Both Nvidia (NASDAQ:NVDA) and Qualcomm (NASDAQ:QCOM) are down almost 4% in Wednesday afternoon’s trading. Texas Instruments (NASDAQ:TXN) is down over 4%, and Intel (NASDAQ:INTC) is down almost 5%. The hardest hit, meanwhile, is AMD (NASDAQ:AMD), down over 5% in a brutal trading session.

So what in the world happened to so many chip stocks so rapidly to cause this kind of drop across the entire field? We start with a report from Bank of America, which says that the upside potential for AMD and Intel for the rest of 2023 is likely to be “limited.” Investor focus, meanwhile, will be pivoting to 2024.

Throw in rising geopolitical tensions that could impact sales for both, as well as some specific “headwinds” for AMD in its console and embedded sales, and that spells potential trouble. However, for AMD, everyone will be watching the MI300, and that could turn things around.

Meanwhile, a troubling report out of Texas Instruments didn’t help matters any. Texas Instruments—which has long been considered a “bellwether” for the chip sector—noted that it saw declining industrial demand for its product line.

Its forecast for the next quarter also proved disappointing, and that got analysts and investors alike wondering about just how healthy the chip sector actually is right now. The big problem all around seems to be less about supply and more about demand. Demand destruction may be kicking in—especially as the consumer is still pressed hard by inflation—and that could be troubling the entire sector.

What are the Best Chip Stocks to Buy Right Now?

Turning to Wall Street, INTC stock is currently the laggard in upside potential. This Hold-rated stock offers just 11.32% upside potential on its $36.67 average price target. Meanwhile, NVDA stock remains the high-water mark for upside, as this Strong Buy-rated stock’s $645.53 average price target yields 53.8% upside potential.