As China has reopened following the pandemic closures, a weaker macro and consumption environment has negatively impacted Chinese-based firms. Social media company Weibo (NASDAQ:WB) has been no exception. The stock is down 80% over the past three years. Yet, it trades at a discount, making it an intriguing option for value investors looking to participate in the Chinese economic recovery.

Weibo’s Economic Fortunes

Weibo is a leading social media company in China. It specializes in the creation, distribution, and discovery of Chinese-language content.

The company has faced significant challenges in the past year, primarily driven by rapid changes in user interests in a post-pandemic world. A notable decline in the demand for news and trending content and increased demand for vertical content has required an accelerated evolution from the company. Despite these challenges, Weibo’s user base sustained positive growth. It concluded December 2023 with 598 million monthly active users and 257 million daily active users, reflecting a net addition of approximately 5 million users on a year-over-year comparison.

However, the pace of the consumer market’s recovery post-pandemic has not met expectations, which have resulted in a decrease in the brand advertising budget for some customers. Consequently, Weibo’s advertising business has been adversely impacted, translating to a revenue drop.

Weibo’s Recent Financial Results

Weibo recently reported fourth-quarter financials. The company’s Q4 revenue was $463.67 million, showing an increase of 3% year-over-year and 5% quarter-over-quarter, overperforming the forecasted consensus of $455.09 million. However, the company reported earnings per share (EPS) of $0.31, falling short of the consensus estimate of $0.49.

Total revenue for the year was $1.76 billion, a decrease of 4% compared to the previous year. Similarly, total ad revenues decreased by 4% year-over-year, totaling $1.53 billion. Net income stood at $450.6 million, translating to a diluted EPS of $1.88.

As of December 31, 2023, Weibo’s cash, cash equivalents, and short-term investments amounted to $3.23 billion, a slight increase from $3.17 billion as of December 31, 2022. Citing their solid profitability and strong cash flow, the company’s Board of Directors has approved a special cash dividend of $0.82 per ordinary share. The aggregate amount of this dividend is expected to be approximately $200 million.

What is the Price Target for WB Stock?

The stock has been trending down, shedding almost 45% in the past year. It continues to demonstrate negative price momentum, trading below the 20-day (8.10) and 50-day (8.28) exponential moving averages. The extended slide in price has pushed the stock into value territory, with a P/S ratio of 1.1x, sitting well below the Communication Services sector average of 2.5x and the Internet Content & Information industry average of 5.7x.

Analysts covering the company have mostly taken a wait-and-see stance on the stock. For instance, HSBC analyst Charlene Liu recently lowered the price target on Weibo to $9.80 from $13.60, while keeping a Hold rating on the shares. She cited slowing year-over-year growth and continual downgrades leading to reduced new product launches and initiatives.

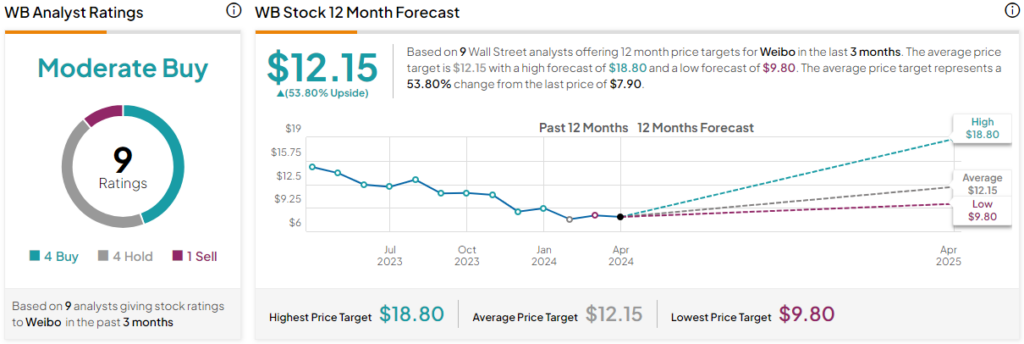

Weibo is rated a Moderate Buy based on the recommendations and 12-month price targets that nine Wall Street analysts have assigned over the past three months. The average price target for WB stock is $12.15, which represents a 53.8% upside from current levels.

Final Analysis of Weibo

The reopening of China has presented a challenging environment for social media titan Weibo. However, the company has been adapting to rapid changes in user interests in the post-pandemic period, and the now-discounted asset could present an attractive opportunity for value investors looking to capitalize on China’s potential economic recovery.